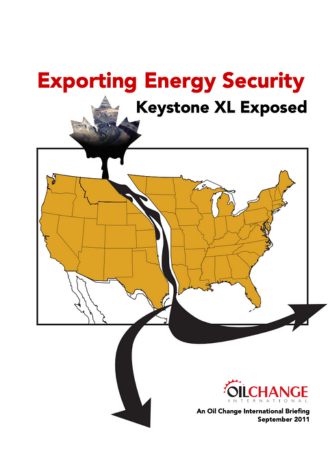

Report: Exporting Energy Security: Keystone XL Exposed

Keystone XL will not lessen U.S. dependence on foreign oil, but rather transport Canadian oil to American refineries for export to overseas markets.

The Keystone XL Pipeline: Oil for Export, Not for U.S. Energy Security

Industry Documents Reveal Scheme to Reach Lucrative Markets Abroad

In pushing for the Obama Administration’s approval of TransCanada’s proposed Keystone XL tar sands pipeline, the North American oil industry and its political patrons argue that the pipeline is necessary for American energy security and its construction will help wean America of dependence on Mideast oil. But a closer look at the new realities of the global oil market and at the companies who will profit from the pipeline reveals a completely different story: Keystone XL will not lessen U.S. dependence on foreign oil, but rather transport Canadian oil to American refineries for export to overseas markets.

A new report from Oil Change International lays out the case, based on data and documents from the U.S. Energy Information Administration and the Canadian National Energy Board, corporate disclosures to regulators and investors, and analysis of the rapidly shifting oil market.

The facts:

Keystone XL is an export pipeline. The Port Arthur, Texas, refiners at the end of its route are focused on expanding exports to Europe, and Latin America. Much of the fuel refined from the pipeline’s heavy crude oil will never reach U.S. drivers’ tanks.

Valero, the key customer for crude oil from Keystone XL, has explicitly detailed an export strategy to its investors. Because Valero’s Port Arthur refinery is in a Foreign Trade Zone, the company can carry out its strategy tax-free.

In a shrinking U.S. market, Keystone XL is not needed. Since the project was announced, the oil industry acknowledges that higher fuel economy standards and slow economic growth mean declining U.S. oil demand, even as domestic production is booming. Oil from Keystone XL will therefore displace American crude from new, “unconventional” domestic fields in Texas or North Dakota.

“To issue a presidential permit for the Keystone XL, the Administration must find that the pipeline serves the national interest,” said Stephen Kretzmann, executive director of Oil Change International. “An honest assessment shows that rather than serving U.S. interests, Keystone XL serves only the interests of tar sands producers and shippers, and a few Gulf Coast refiners aiming to export the oil.”

Valero has contracted to take at least 100,000 barrels of tar sands crude a day from Keystone XL until 2030. It’s publicly disclosed business model relies on refining heavy sour crude for export. It is upgrading its Port Arthur refinery to process heavy sour into diesel fuel. Its investor presentations clearly show it plans to ship diesel to Latin America and Europe.

Valero – the Texas independent behind last year’s attempt to overturn California’s clean fuel standards – is the only U.S. company among the six customers who have jointly committed to purchase 76 percent of Keystone XL’s initial capacity. The other refiners are Shell, which is part of Motiva, a joint venture between Royal Dutch Shell and the Saudi government, and Total of France, both of which have newly upgraded facilities in Port Arthur tax-free trade zones. There are also two Canadian producers and one international oil-trading firm in the group of six customers.

“Oil is a fundamentally global market – the idea that the pipeline enhances our energy security is a scam.” said Kretzmann. “Let’s hope the Obama Administration doesn’t fall for it. In fact, the only way to truly reduce our dependence on foreign oil is to reduce our dependence on all oil. Let’s not fool ourselves that we will achieve ‘energy independence’ by serving as a middleman for access to overseas markets.”

###