New York City Could be Next to Disinvest from #DAPL

The Mayor of New York, Bill de Blasio, has confirmed that he is “very interested” is using the city’s pension funds to put pressure on the banks that are helping to fund the highly controversial Dakota Access pipeline.

The Mayor of New York, Bill de Blasio, has confirmed that he is “very interested” is using the city’s pension funds to put pressure on the banks that are helping to fund the highly controversial Dakota Access pipeline.

“I think what’s happening with the Dakota Access pipeline is just plain wrong,” the mayor said late last week. “I think what the Trump administration did is wrong.”

“I don’t know enough about which companies are involved but I’m certainly interested in anything we can do to avoid that pipeline destroying the Earth and harming Native American people,” de Blasio added. “If there’s a way we can use our pension fund power in that equation, I’m very interested.”

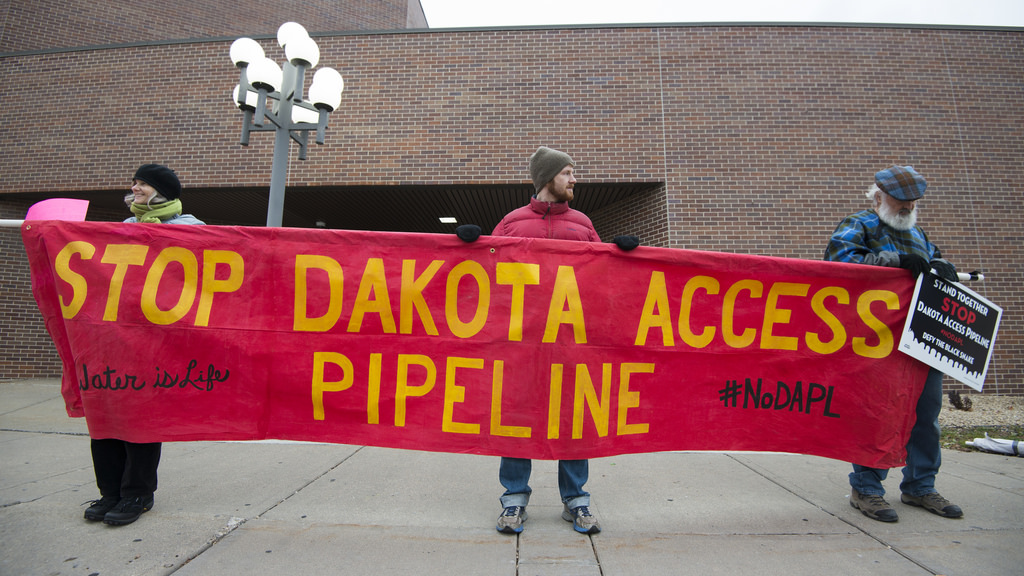

Indeed, the disinvestment campaign against the pipeline seems to be gathering traction, as anger grows against the Trump Administration’s approval of the pipeline after months and months of resistance by First Nations and environmental activists.

As we reported early last week, in a significant blow to Energy Transfers the company building the pipeline, the city of Seattle became the first major US city to terminate its relationship with a major bank, Wells Fargo, in protest of it providing a credit facility to the pipeline. The move denies the bank access to $3 billion of funds.

And late last week, the Financial Times reported that the Nordic bank, Nordea had banned its fund managers from investing in the companies constructing the pipeline

The bank’s fund management division will no longer invest in Energy Transfer Partners or Sunoco Logistics, which is buying Energy Transfers as well as Phillips 66, which owns a minority stake in the project.

Sasja Beslik, head of sustainable finance at Nordea Wealth Management, told the paper: “Our conclusion was that consultation with [the] Standing Rock [tribe] needs to be improved and the pipeline route moved from the disputed area.”

In addition, over 40,000 signatures have been collected calling on two of the largest US pensions funds, CalPERS and CalSTRS, which have $100 million invested in Energy Transfers to disinvest too.

A bill is now being proposed in the California state assembly to require the two pension funds from putting any further funds into the pipeline. CalSTRS said its board is due to discuss the issue in April.

For now CalPERS, a $300 billion fund, is continuing to invest. “There is considerable evidence that divesting is an ineffective strategy for achieving social or political goals, since the consequence is generally a mere transfer of ownership of divested assets from one investor to another,” ssaid the pension fund in a statement published on its website.

The news comes as US army veterans have started returning to Standing Rock to protect the Indigenous “water protectors” who are still at the camp despite freezing conditions. “We are prepared to put our bodies between Native elders and a privatised military force,” air force veteran Elizabeth Williams told The Guardian newspaper. “We’ve stood in the face of fire before. We feel a responsibility to use the skills we have.”