Fund managers recognise “imminent risks posed to fossil fuel investments from climate change”

“The fund management sector recognises the imminent risks posed to fossil fuel investments from climate change and the transition toward a zero-carbon economy”

Earlier today, oil giant Shell surprised analysts with better than expected first quarter results, as earnings “surged” on the back of rising oil prices.

Shell’s CEO, Ben van Beurden, was bullish in a statement: “Shell’s strong earnings this quarter were underpinned by higher oil and gas prices, the continued growth and very good performance of our Integrated Gas business, and improved profitability in our Upstream business”, he said.

Even the press was optimistic about the prospects for Big Oil in the short-term. “The latest figures come at a time when the environment for oil companies is dramatically improving, amid signs the energy market is rebalancing and crude futures have rallied to multi-year highs,” reported CNBC.

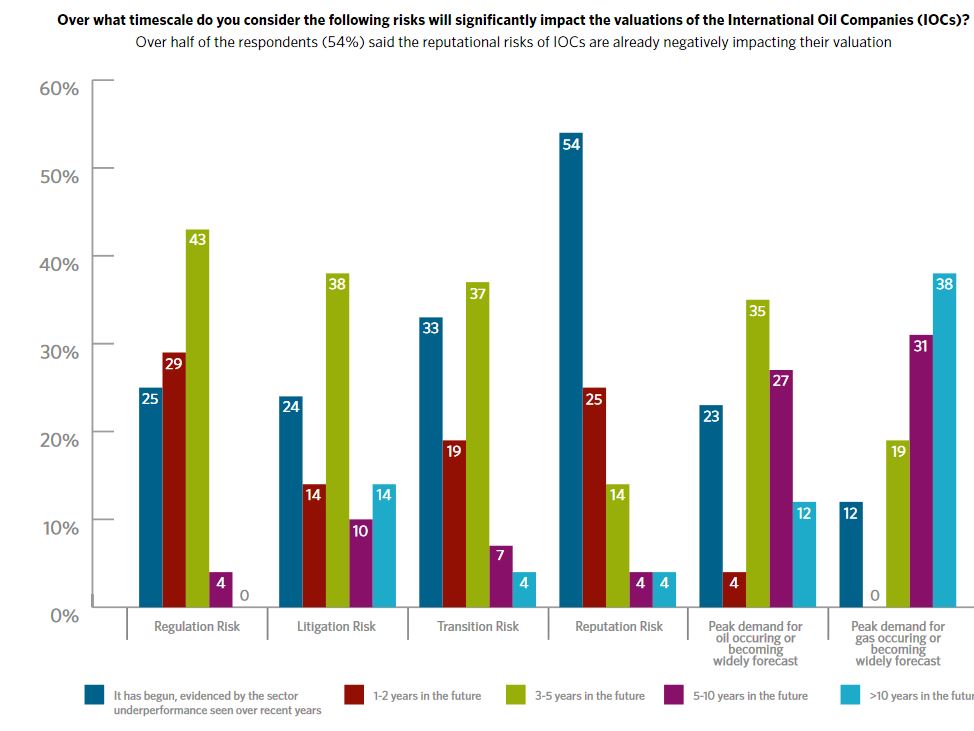

But Shell’s short-term profit surge masks much deeper storm clouds that are gathering on the horizon. As an article in Forbes today reports: “Three risks that are haunting Big Oil … A recent survey reported that fund managers believe International Oil Companies (IOCs) will be negatively revalued within a few years due to climate change related risks.”

Forbes was writing about the results of a new survey, entitled “Not long Now” by the UK’s Sustainable Investment and Finance Association (UKSIF) and the Climate Change Collaboration, which examined the views of fund managers on the issue of oil and climate change. The three risks concerned are squeezing the industry from all sides:

“Reputational damage because of their role in causing climate change;

Litigation for losses from climate change; and

Regulation to curtail fossil fuel pollution.”

The 30 fund managers surveyed hold collectively over $18 trillion in assets under management. Despite this financial influence, fund managers are often the hidden link in the oil chain. However, if they lose confidence in the companies they invest in, believing that their investments will become stranded assets and the finance for the industry dries up, even corporate Goliaths like Shell could be in real trouble. And that could happen much sooner than the companies themselves predict.

The report’s conclusions are stark for the oil industry: “The fund management sector recognises the imminent risks posed to fossil fuel investments from climate change and the transition toward a zero-carbon economy”.

It adds the fund manager sector is “clear that International Oil Companies (IOCs) will be negatively revalued within a few years because of climate change related risks”. Some 90% of fund managers expect at least one of the risks above “to impact significantly the valuation of IOCs within 2 years”.

As the report outlines, there are “also risks associated with the energy transition – such as the increasing competitiveness of alternative energy technologies leading to a drop in demand for fossil fuels and a shift in market sentiment as investors lose faith in IOCs ability to transition in a financially successful manner.”

In all, says the report, some “89% of managers agreed that these and other transition risks would impact valuations of the IOCs ‘significantly’ in the next 5 years.”

And things have got much worse for the industry in the last year: “It’s noteworthy that perceptions of these risks have increased dramatically in the last twelve months. Since last year there is a doubling of investors that see transition risk significantly impacting IOCs in 5 years.”

Furthermore, over half of respondents – some 54 per cent – said the reputational risks of IOCs are already negatively impacting their valuation. Indeed, 67% said reputational risk had grown in the last 12 months, including 30% that said it has “grown significantly”.

Despite all the greenwashing by oil companies, most recently by Shell in its Energy Transition report, that they are committed to a low carbon future, a whopping 71% of fund managers “have not decided if they believe fossil fuel companies are able to make a transition to a zero carbon economy.”

And to re-iterate the risks of disinvestment from oil and gas, especially how quickly things can change, yesterday Statistics Canada published data which revealed that there had been a “sharp slowdown” in foreign capital inflows last year into the country, “which was energy-related.”

Investment in the oil and gas sector – predominelty the dirty tar sands – fell by the largest amount in at least 17 years — down 12.2 per cent to $120 billion.

Indeed, the dirty tar sands, risky fragile Arctic or filthy carbon-munching coal might be the first places where investors take flight from fossil fuels but soon it could be any fossil fuel investment, anywhere. Times they really are a changing.

But as Forbes says: “The question, as ever, remains to what extent Shell, it its compatriots like Chevron and Exxon, have really understood how the market (and perceptions of the market) are changing, and the extent to which they are prepared to face that change.”