It’s time to imagine a future without Shell

So can a company often vilified for being complicit in human rights abuses in Nigeria, accused of rampant pollution and ignoring the risks of climate change for decades, be central to the climate fight?

Read the latest insights and analysis from the experts at Oil Change International.

So can a company often vilified for being complicit in human rights abuses in Nigeria, accused of rampant pollution and ignoring the risks of climate change for decades, be central to the climate fight?

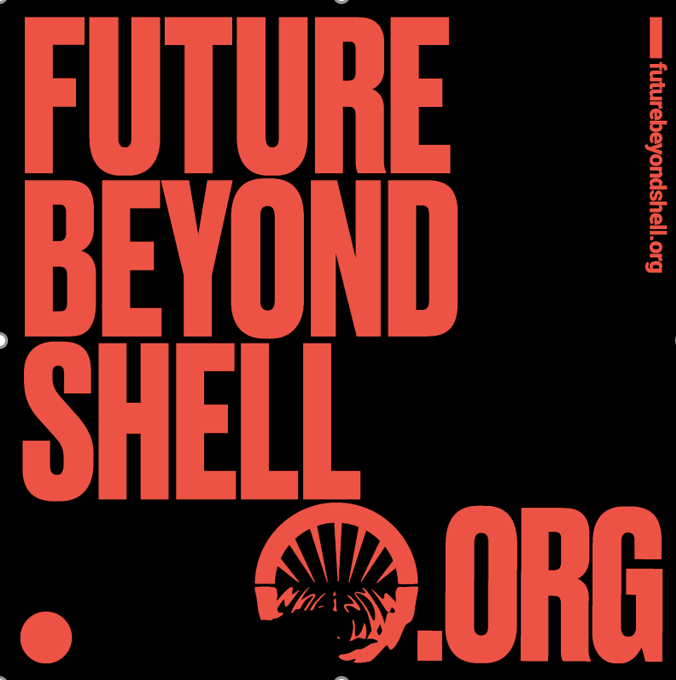

A new report, published today by UNEP and other environmental groups, outlines the “Production Gap”, the discrepancy between countries’ planned fossil fuel production and global production levels consistent with limiting warming to 1.5°C or 2°C.

If the IEA is serious about helping governments sustainably tackle interlocking economic and climate crises, they have one more chance to prove it with their data: by making a 1.5-aligned energy pathway central to the 2020 World Energy Outlook.

As governments begin to unveil trillions of dollars in recovery support and stimulus, now is the time to break old habits – such as the USD 77 Billion in public money that the G20 is still spending annually to finance oil, gas, and coal projects.

With the health and livelihoods of billions at risk from COVID-19, governments around the world are preparing historic levels of stimulus finance. Building a Just Recovery that avoids the worst of climate change means overhauling our public finance institutions fast.

This week the seemingly impossible happened: U.S. oil futures prices went negative for the first time in history. What happens next is up to us.