“Double Dip” Oil Plunge Gets “Ugly” For The Tar Sands

Those in the oil industry hoping for a reprieve from the volatility of the oil price had their hopes dashed yesterday as the price of oil dropped to its lowest level in four months.

Read the latest insights and analysis from the experts at Oil Change International.

Those in the oil industry hoping for a reprieve from the volatility of the oil price had their hopes dashed yesterday as the price of oil dropped to its lowest level in four months.

A year on from the start of one of the biggest oil price plunges in recent history, it seems there is going to be no let-up in the turbulence caused by the oil price fluctuations.

There has been increasing speculation over the last twenty-four hours that the oil price might start to rally upwards.

As world leaders converged on the Swiss town of Lausanne over the weekend, their historic deliberations about Iran’s nuclear programme were said to have reached the “end-game” before the deadline at the end of the month.

Resource sovereignty, OPEC and climate change: implications for Ecuador in the struggle to protect biodiversity and indigenous rights in Yasuni National Park

In a sign that the oil price plunge is really beginning to bite, yesterday oil giant Royal Dutch Shell announced that the company is indefinitely postponing plans to develop a new tar sands mine in northern Alberta.

Everywhere you look there is carnage in the oil industry as the reality of low oil prices begins to bite. From North America, to the North Sea and the Arctic, the low crude oil price is reshaping the size, shape and prospects of the industry.

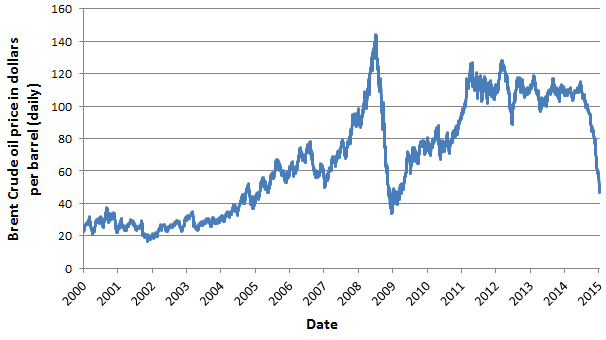

Just how low can the oil price go? What was unthinkable even a few months ago is now becoming distinctly probable, even likely. As analysts dissect the ramifications for the oil industry of $40 dollar barrel, oil traders are now thinking that the price of crude will halve that to a staggering $20 a barrel. Prices have not been that low for twenty years.

The new year has started just like the old one ended, with the oil price continuing its downward slide. This morning oil dropped to five and a half year low as over supply continued to spook the markets.

And so the free-fall continues. The price of Brent crude has fallen this morning below $60 a barrel for the first time since July 2009. The price of US crude is below $55.