Certified Disaster: How Project Canary and Gas Certification Are Misleading Gas Markets and Governments

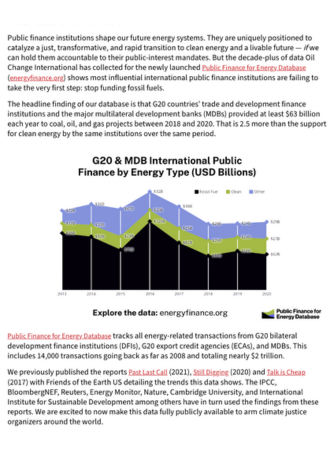

A new report by Oil Change International and Earthworks examines the rapid growth in “certified gas” and exposes on-the-ground failures to detect oil & gas pollution by one of the largest certifiers of methane gas.