Madness Is The Method: How Cheniere is Greenwashing its LNG With New Cargo Emissions Tags

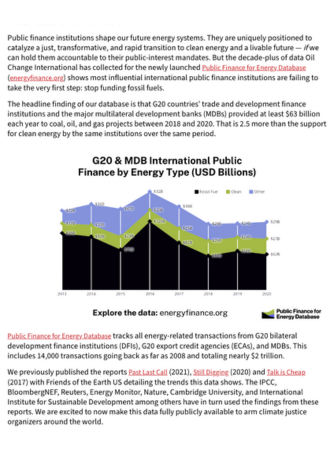

Our new report finds that Cheniere’s new lifecycle emissions tags appear to be pinned to a misleading methane emissions analysis that woefully undercounts actual leakage volumes.