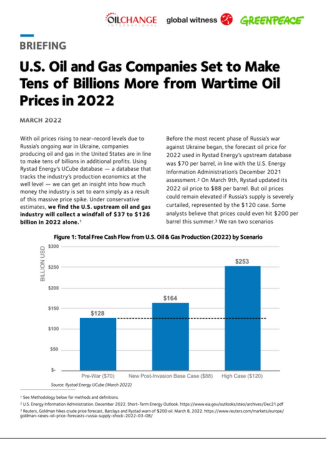

Companies set to make £11.6 billion windfall on UK oil and gas in 2022

This briefing shows that companies are set to make £11.6 billion windfall on UK oil and gas in 2022 and why the UK government is missing this opportunity to fund an energy transition.