Keystone XL: Undermining Energy Security

The Keystone XL pipeline has been presented as a boon to U.S. energy security by its proponents. It is no such thing.

Oil Change International and Natural Resources Defense Council

Oil Change International and Natural Resources Defense Council

January 2012

Download the Full Report

Download Summary

The Keystone XL pipeline has been presented as a boon to U.S. energy security by its proponents. It is no such thing.

The oil industry is not concerned with U.S. energy security or the U.S. national interest. It is purely interested in maximizing profits.

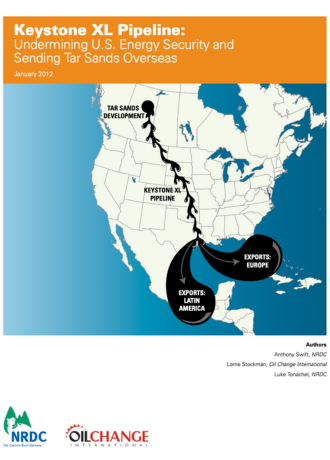

For tar sands producers, maximizing profits means breaking out of the Canadian and American Mid West markets, which are currently saturated with tar sands oil leading to a reduced price for the commodity. A pipeline to the Gulf Coast achieves this goal.

For Gulf Coast refiners, who face a declining domestic market due to a stagnant economy and rising vehicle efficiency, maximizing profits means tapping into a burgeoning international market for petroleum products. 25 percent of Gulf Coast refinery output is now going to export and Keystone XL will feed this growing trend because the heavy sour oil derived from tar sands is ideal for producing diesel, the product most in demand on the export market.

This report shows how Keystone XL will help maximize Big Oil’s profits while doing nothing to enhance U.S. energy security. It explains that:

there is currently a glut of pipeline capacity from Canada to the U.S. with around 50% currently unused;

Canadian oil production is not forecast to fill existing pipeline capacity until after 2025;

this means that Keystone XL would simply be diverting oil to the Gulf Coast that would have supplied the Mid West;

this will likely raise the price of Canadian oil in the Mid West as Canadian oil moves from surplus to shortage;

Gulf Coast refiners represent a comparatively limitless market because they are able to export products to anywhere in the world;

With U.S. gasoline demand in terminal decline, Gulf Coast refiners are maximizing diesel output to serve the export market;

With 25% of refinery output and growing going to export, the Gulf Coast is becoming an international refining center in which U.S. domestic demand is becoming increasingly irrelevant.

Even if the U.S. was self sufficient in oil or importing oil only from Canada, it would not be insulated from the vagaries of the global oil market. A supply disruption in the Middle East or Nigeria for example, or rising prices as a result of spiking demand in emerging economies, would result in high prices at the pump for U.S. consumers. The only way to ease the impact of unstable and expensive oil is to reduce our dependence on it.

The report also details how America can create tens of thousands of jobs and genuinely enhance energy security by cutting nearly 6 million barrels per day from its oil demand by 2030. This would be a boon to the U.S. economy, U.S. energy security and the health of our climate, air and water.

Download the Full Report

Download Summary