Holding Course, Missing Speed: Protecting progress on ending fossil fuel finance and unlocking clean energy support

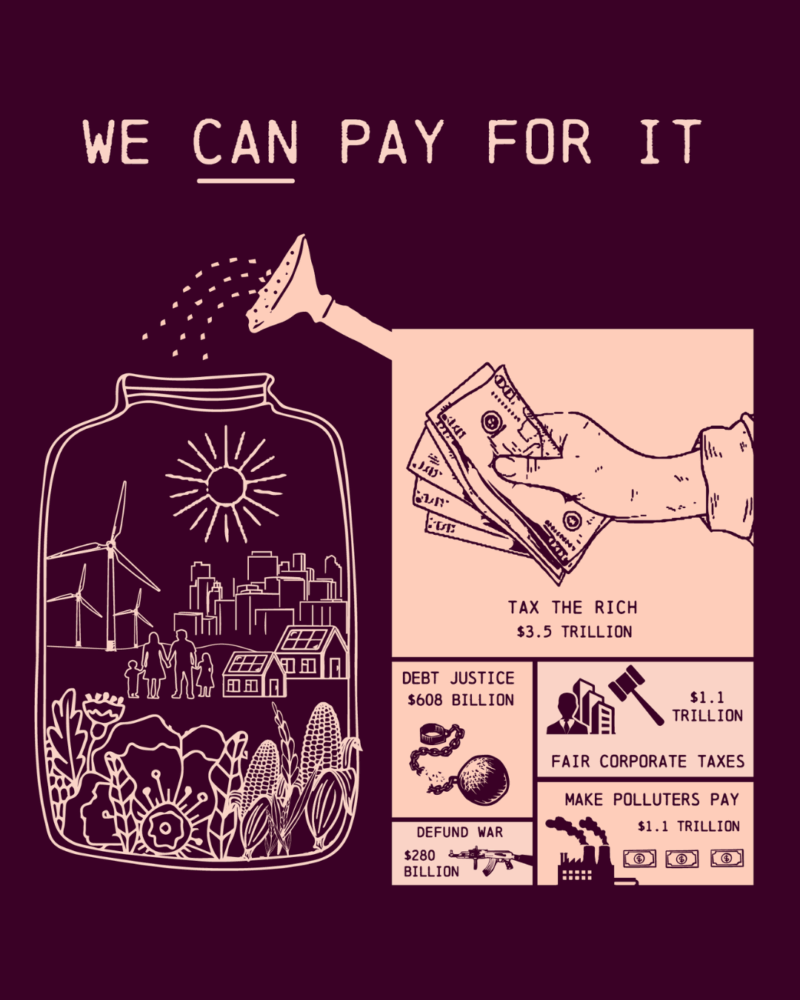

This report finds that CETP members cut fossil fuel finance by up to 78% but need to rapidly scale up finance for renewables and close loopholes that allow continued fossil finance.