Enbridge Intends to Take Enormous Subsidy for Alberta Clipper Tar Sands Pipeline

Enbridge is side-stepping environmental regulations and corporate taxes in attempts to increase Canadian tar sands exports through the United States.

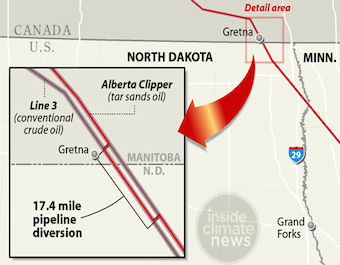

Enbridge’s tar sands diversion across the U.S.-Canada border to avoid proper review of the Alberta Clipper expansion (image credit: Paul Horn, InsideClimate News)

On September 17, Enbridge Inc. proposed to “drop down” its 66.7% interest (worth $900 million in cash and equity) in the Alberta Clipper tar sands pipeline to its subsidiary, Enbridge Energy Partners, which currently holds the other 33.3% interest. Enbridge Energy Partners already has high stakes in the Canadian tar sands through the extensive Lakehead pipeline system, which accounts for more than 60% of Canadian oil exports to the U.S.

Enbridge plans to expand the Alberta Clipper’s capacity to transport Canada’s tar sands into the United States. In July, the company received an illegal go-ahead from the U.S. State Department (that it clearly hoped would go unnoticed by tar sands opponents) to increase the volume of tar sands shipments in the Alberta Clipper by diverting a portion to a parallel pipeline, just at the section that crosses the border. These “legal gymnastics” allow Enbridge to expand tar sands transport without going through the proper approval process, including an environmental impact assessment.

Now in addition to this illegal maneuvering, Enbridge is seeking to take advantage of an enormous U.S. tax loophole for the Alberta Clipper pipeline. Enbridge Energy Partners, which will fully own Alberta Clipper by the end of the year if the drop down proposal goes through, is a U.S. Master Limited Partnership (MLP) arm of Enbridge. As an MLP, Enbridge Energy Partners is exempt from paying corporate income taxes, and instead pays out handsome dividends (known as ‘distributions’) to its individual shareholders (known as unit holders). Unit holders are not taxed on income but only on gains made when selling units. MLPs are therefore a tax avoidance scheme for corporations and a tax deferral scheme for shareholders, described by Forbes as “income and a tax shelter rolled into one investment”. In 2012 alone, the U.S. government lost an estimated $3.9 billion due to foregone revenue from this MLP subsidy.

Four out of five MLPs are fossil fuel companies, due largely to the fact that only companies that earn 90% of more of their income from natural resources, commodities, or real estate are eligible for the MLP structure (although due to an arbitrary provision in the MLP rule, energy companies that use “inexhaustible” renewable resources like wind and solar do not qualify.

Pipeline and other midstream oil and gas companies have been particularly active in adopting the MLP structure. However, it seems nonsensical that Enbridge Energy Partners, a company worth $12.8 billion (Enbridge Inc. is worth over $40 billion), should be able to take advantage of this tax loophole, which was originally implemented to help energy companies raise capital from small investors.

Earlier this week, the Obama Administration established new rules (through the Treasury Department’s authority, due to Congressional inaction on the issue) to close a different loophole, tax inversions that allow companies to avoid paying corporate taxes by moving their headquarters overseas. Previously, in 2006, Canada’s government responded to abuses of the Canadian royalty trust structure (its version of the MLP) by announcing a phase-out of the corporate tax exemption for these energy and natural resource companies that was completed in 2011. These reforms set a clear precedent for eliminating MLP tax exemptions in the U.S.

Enbridge’s recent actions around the Alberta Clipper, from its refusal to abide by permitting processes to side-stepping corporate taxes for the project, show that the company will push laws to their limit in order to make a profit. President Obama’s current focus on ending unfair tax loopholes for large corporations, along with Enbridge’s ongoing flaunting of U.S. regulation, make for an opportune moment to take on MLPs – and for the Obama Administration to reject the Alberta Clipper expansion.