Pipeline delays will cost ETP $750M this year

Energy Transfer Partners (ETP) just made a remarkable confession that vindicates investors who abandoned the company over its shameful behavior at Standing Rock.

During its quarterly earnings call with analysts last week, ETP announced that spending for 2018 would increase to $4.5 billion — $1.5 billion more than its estimate just three months prior. When asked about the massive bump in spending, CFO Thomas Long said “about half of that increase” is associated with delays on its Mariner East 2 (ME2) and Rover pipelines.

Put simply: ETP executives admitted that delays in constructing two of its major pipelines are costing investors three-quarters of a billion dollars.

Both Rover and ME2 were supposed to have been flowing by mid 2017. But construction on both lines has been repeatedly suspended by various government agencies in response to multiple violations of state and federal law by ETP and its contractors including:

Bulldozing a historical building it had promised to preserve.

Losing 146,000 gallons of drilling mud underneath the Tuscarawas River.

Spilling more than 220,000 gallons of drilling mud into various aquifers, streams and wetlands across Pennsylvania.

Spilling 2 million gallons of drilling mud into a rare Ohio marshland.

Contaminating drinking wells.

Refusing to pay fines brought by state authorities for its lawbreaking.

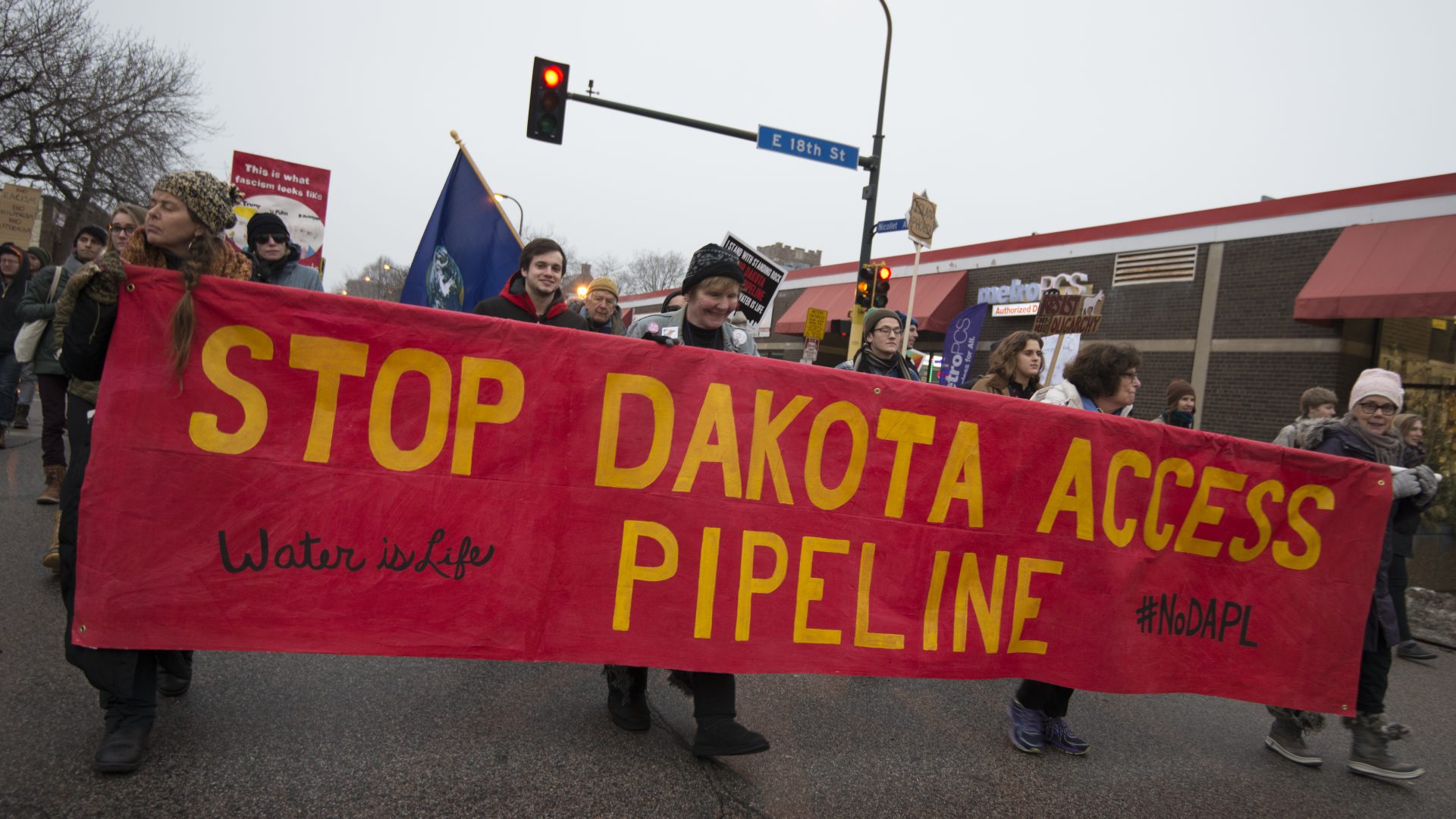

And investors should have seen it coming. ETP’s outlaw culture was at the root of the conflict at Standing Rock where it:

Bulldozed sacred sites claimed by Standing Rock one day after the Tribe filed evidence with a federal court seeking protection of the area.

Sicced attack dogs on Tribal members seeking to stop those bulldozers using an unlicensed security firm with a penchant for inciting violence.

Refused two requests from federal authorities to pause construction near the disputed site to cool tensions.

No matter the pipeline, ETP seems incapable of reining in its slash-and-burn instincts. Just this week, a Federal judge in Louisiana halted construction on a section of the Bayou Bridge Pipeline citing “permanent harm to the environment” — specifically, the clearing of centuries-old cypress trees within the Atchafalaya Swamp. In evidence submitted to the court, ETP claims court-imposed delays could cost $950,000 per day.

With liabilities mounting, the decision by investors like Norwegian pension KLP and DNB bank to divest from ETP seems eminently reasonable. ETP’s stock price has declined 25% since KLP divested in March of 2017.

For more on the effort to expose ETP’s reckless disregard for people and the planet, and ways to get involved, visit StopETP.org.