US “Not Immune” to Oil Price Hike

As war rages in Iraq, and oil and gasoline prices rise, the impotence of the US oil boom is exposed.

For years the American oil industry has argued that the ongoing U.S. oil boom will bring about “energy independence” and drive gasoline prices down. Americans are supposed to be enjoying an era of cheap, plentiful energy.

For years the American oil industry has argued that the ongoing U.S. oil boom will bring about “energy independence” and drive gasoline prices down. Americans are supposed to be enjoying an era of cheap, plentiful energy.

As the oil industry has set about fracking America, decades of declining production has been reversed in just a handful of years. The US is now the world’s largest producer of oil and gas.

The oil industry has persuaded or forced communities across North America to compromise their water supplies and their health to allow the fracking revolution with the promise of lower prices and energy security.

So American consumers should apparently be appreciating the impact of the country’s shale revolution as crude oil and condensates production has just surpassed its previous peak, reached way back in 1970. A 44-year old record has just been broken.

Not so. As the Energy Policy Information Centre pointed out, at the end of last month. “Despite all the promise of the oil boom, for most Americans, its economic benefits remain an abstract concept in the absence of relief at the gas station.”

The sad truth is that despite the US economy being half as “oil intense” compared to the 1970s – as measured by barrels of oil consumed per $1,000 of GDP – American households and businesses still spend a staggering 900 billion dollars annually on petroleum. The average American household dedicates around 5.3% of its spending to petroleum, with the burden felt much more heavily by low income households.

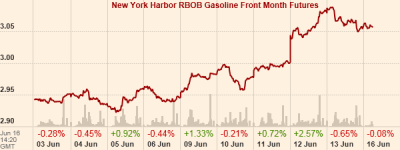

And here comes the real irony. Despite the US reaching a record production peak, last week the price of Brent crude rose 4 per cent (an imporatnt benchmark price for oil purchases worldwide), its biggest one-week rise since July last year. Wholesale US gasoline rose with it and thus US consumers will notice higher pump prices probably as soon as this week (see chart).

And the reason is the ongoing turmoil in Iraq. The escalating violence there is threatening supplies from OPEC’s second largest producer, which produces in excess of 3 million barrels of oil a day.

Bloomberg is quoting Societe Generale saying that if the violence escalates and production is affected, Brent crude may jump from its current position of $113 to $120 or even $125. It may go even higher.

“This is a serious situation in terms of the global oil market,” Victor Shum, a vice president at IHS Energy Insight in Singapore, told Bloomberg. “This situation in Iraq really threatens potential supply growth going forward.”

So far the fighting has not spread to the south, where the US Energy Information Administration estimates that three-quarters of Iraq’s crude output is produced. But if the Southern oil fields fall, the global oil price could skyrocket to unprecedented levels.

What this shows, as Ed Crooks, points out in today’s Financial Times is that, despite its own fracking revolution, “the US is not immune to the effects of disruption in world markets.”

Put simply the oil boom has not insulated American consumers from the price spike that the violence in Iraq will cause. And Iraq is not the only major oil producer with ongoing political instability. Think about recent events in Nigeria, Venezuela and Libya, to name just three.

The boom that is needed in order to truly insulate the American economy from the relentless turmoil in oil producing countries is a boom in efficiency, public transit, smart growth and electric vehicles. These technologies and policy initiatives are here now and ready to go, but the political and financial weight behind them has been overshadowed by the lure of oil boom riches.

Instead of “All of the Above“, we need energy policies that will help American’s reduce the amount of oil they need to buy, at any price.