It’s not just oil that’s in trouble: “Gas is over-supplied, over-hyped, and out of time”

"Shell has been a leader in peddling the gas myth for a decade or more, and it’s now clearer than ever that gas is over-supplied, over-hyped, and out of time.”

Read the latest insights and analysis from the experts at Oil Change International.

"Shell has been a leader in peddling the gas myth for a decade or more, and it’s now clearer than ever that gas is over-supplied, over-hyped, and out of time.”

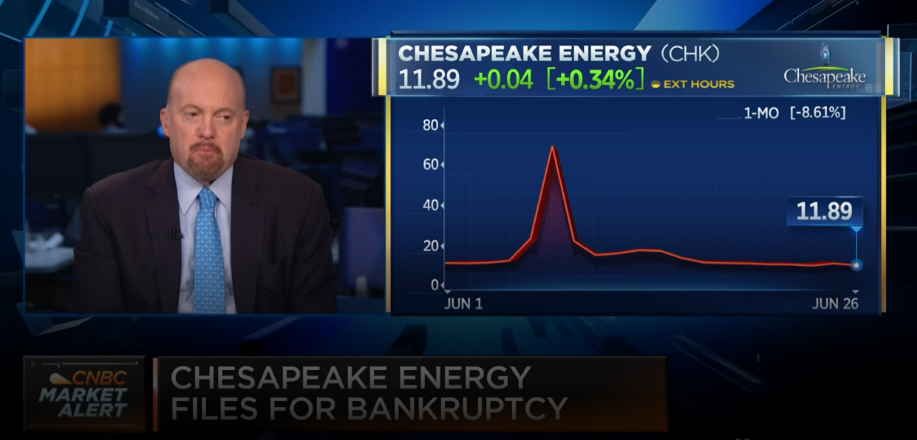

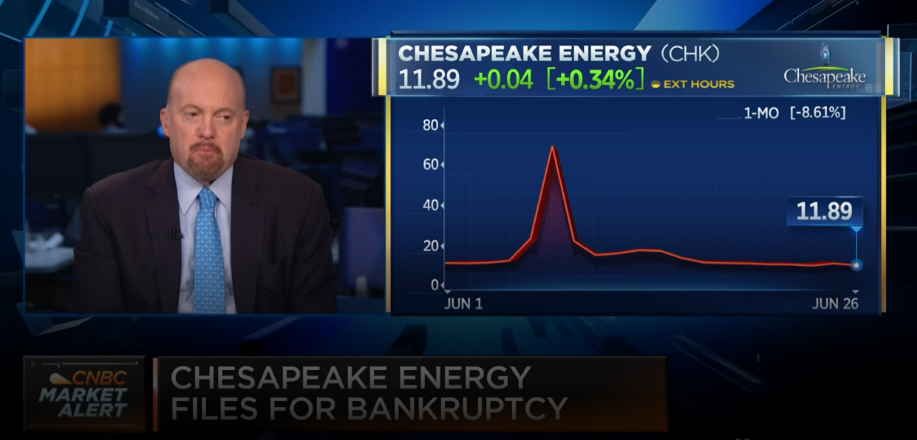

A report from the financial auditing firm Deloitte says the “reality is that the shale boom peaked without making money for the industry in aggregate. In fact, the US shale industry registered net negative free cash flows of $300 billion, impaired more than $450 billion of invested capital, and saw more than 190 bankruptcies since 2010.”

The big beasts of the global oil industry will gather today at one of the most important events in their calendar – the IHS CERAWeek conference in Houston, which is often dubbed the Davos of the energy industry.

Some of the world’s best known oil companies, including Shell, BP, Statoil and Total, face the humiliation of having a ratings downgrade, the internationally respected ratings agency, Moodys, has warned.

There is a temporary reprieve this morning for the oil industry as the oil price has climbed one percent on the news that US drilling has slowed yet again.