Momentum Grows to Stop Coal Finance, but Further Action is Critical

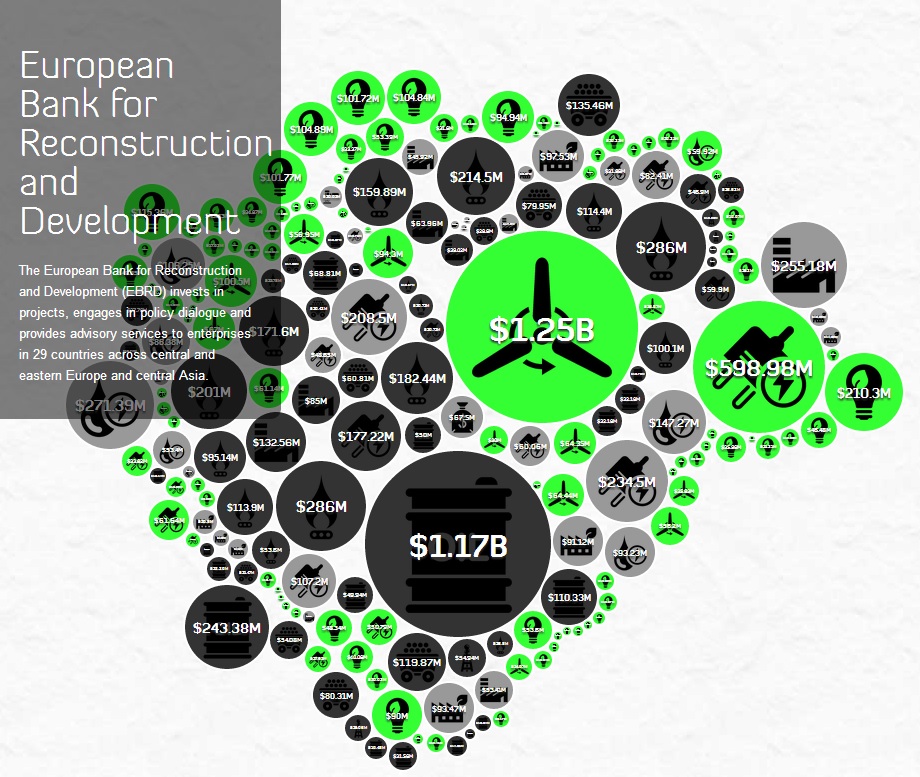

Two important actions were added to the growing list of recent global steps curbing public finance for coal. First, the European Bank for Reconstruction and Development (EBRD) joined the World Bank and European Investment Bank (EIB) in adopting a new Energy Strategy that significantly restricts support for coal power projects. As the second climate feat of the week, the U.S. government voted no on the Board of the Asian Development Bank (ADB) for a proposed coal power plant in Pakistan. However, even though the U.S. and several other countries voted no or abstained from supporting the Pakistan coal plant, the ADB board still had a simple majority, and therefore approved $900 million in funding for the 600 MW Jamshoro coal plant.