Carbon capture has a 50-year record of failure. Why are governments throwing billions of dollars at it?

The current wave of carbon capture projects and government subsidies will only further entrench the fossil fuel industry and its impacts.

Read the latest insights and analysis from the experts at Oil Change International.

The current wave of carbon capture projects and government subsidies will only further entrench the fossil fuel industry and its impacts.

We have known for over a decade just how damaging fracking is to our health. But the health impacts of exporting fracked gas have often been overlooked.

Israel’s government relies on Chevron to extract the rich supply of gas off its coast, making money for a government actively perpetrating a genocide against the Palestinian people. And Chevron relies on Israel – Israel will be Chevron’s third largest source of gas globally over the next twenty years.

Oil Change International condemns the right-wing violence against innocent people in the UK and refuses to remain silent. We are appalled at the brutal and mindless thuggery, racism, violence, Islamophobia, and intimidation against People of Color, immigrants, refugees, and people seeking asylum.

Recent footage and images from Bangladesh are truly shocking. Police and the army firing live rounds at random unarmed protesters in the streets of Dhaka, the Bangladeshi capital.

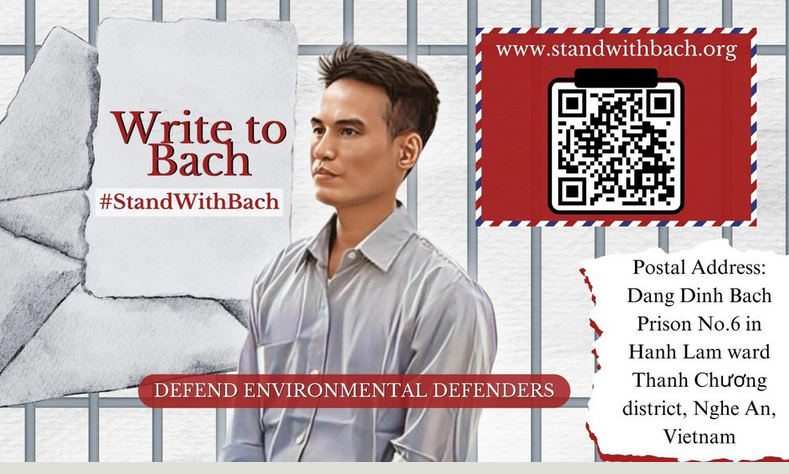

June 24th 2024, marked the third Anniversary of the wrongful arrest and imprisonment in Vietnam of the environmental lawyer and climate justice advocate, Dang Dinh Bach.

Litigation can make or break fossil fuel expansion. As governments fail to meet climate and human rights obligations and spend billions in taxpayer money supporting fossil fuel production, courtrooms are busier than ever settling climate disputes and issuing crucial advisory opinions clarifying States’ obligations.

The COP28 agreement marked the end of the fossil fuel era. Now, will the world’s wealthiest nations step up and pay their fair share to drive this transition?

June 1st, 2024, the grand opening day, came and went —but nothing actually happened. It was the latest of many proposed start dates that have come and gone over the years. The highly controversial Mountain Valley Pipeline (MVP) was meant to start a year ago, then last month, and finally, on June 1st. Again, that deadline was missed.