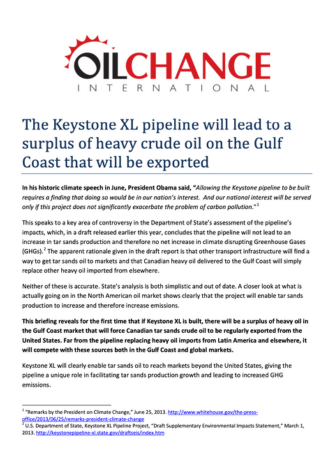

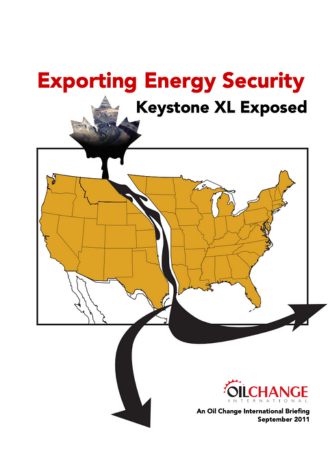

On the Edge: 1.6 million barrels per day of proposed tar sands oil on life support

The Canadian tar sands is among the most carbon-intensive, highest-cost sources of oil in the world. Even prior to the precipitous drop in global oil prices late last year, three major projects were cancelled in the sector with companies unable to chart a profitable path forward.