The Vanishing Need for the Atlantic Coast Pipeline

Diminishing consumer demand coupled with more affordable renewables are casting doubt on the overall feasibility and potential profitability of the Atlantic Coast Pipeline.

Oil Change International publishes upwards of 20 reports and briefings every year focused on supporting the movement for a just phase-out of fossil fuels.

Diminishing consumer demand coupled with more affordable renewables are casting doubt on the overall feasibility and potential profitability of the Atlantic Coast Pipeline.

How the IEA Guides Energy Decisions Towards Fossil Fuel Dependence and Climate Change

Coming two years after the Paris Agreement, the initial public offering (IPO) of Saudi Aramco will be strongly shaped by climate change. Most analysts believe that Crown Prince Muhammad bin Salman’s US $2 trillion estimate of Aramco’s value was unrealistic, reckoning instead on somewhere in the range $1 to 1.5 trillion. But there has been a gap in commentary, on how moves to decarbonise the energy system will affect the IPO’s valuation.

Companies like ExxonMobil, Shell and BP routinely use their in-house energy forecasts to justify investments in multi-decade, high-cost projects, from the Arctic to the tar sands. While the companies present their published forecasts as objective analyses, the forecasts rather reflect the future they want us to believe in.

Each year, federal and provincial governments pay billions in hand-outs to Canada’s coal, oil and gas companies, undermining both existing and proposed climate action in Canada.

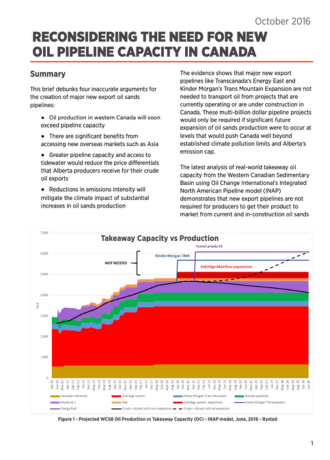

Canada does not need new pipelines, in spite of repeated misleading claims by the oil industry. That’s the conclusion of a new Oil Change International (OCI) analysis showing that Canada has ample pipeline Capacity to export all existing and under construction oil production to market from western Canada.

Dakota Access should be stopped immediately for a long list of reasons. But we must also stop billions of taxpayer dollars from flowing to fossil fuels.

Oil Change International joins hundreds of organizations worldwide that have written to the Extractive Industries Transparency Initiative (EITI) board calling on global reporting standards for extractive industries to include transparency from fossil fuel companies about the future viability of their oil, coal and gas projects in a warming world.

The Joint Select Committee on Deficit Reduction, also called the “supercommittee,” must vote by November 23rd on a plan that would reduce the deficit by at least $1.5 trillion. Ending taxpayer subsidies to oil, gas, and coal companies has been suggested by Democratic leaders in Congress and many organizations as something for the chopping block

Private international oil companies have limited opportunities for growing their oil production. They have been forced to go to the extremes to pursue oil wherever they can get it.