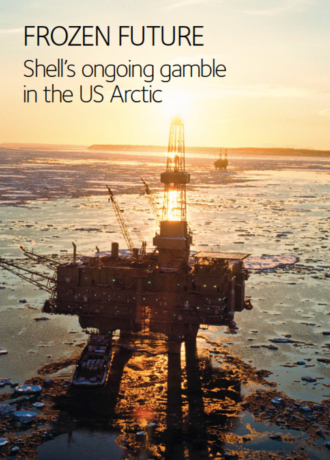

Frozen Future: the gaps in Shell’s Arctic spill response

Shell is currently moving its drilling rigs to Seattle in anticipation of resuming its US offshore Arctic drilling programme in July. However, it is far from clear that Shell has adequate physical or financial plans to deal with the impacts of a major oil spill in this remote region.