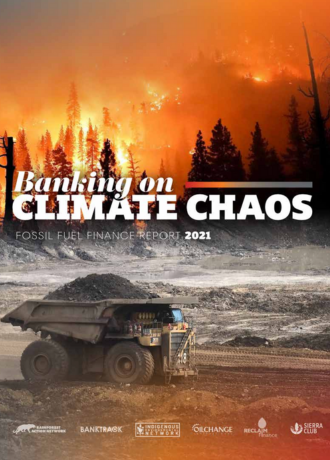

Banking on Climate Chaos 2021: Fossil Fuel Finance Report

This report analyzes fossil fuel financing from the world’s 60 largest commercial and investment banks — aggregating their leading roles in lending and underwriting of debt and equity issuances — and reveals that these banks poured a total of USD $3.8 trillion into fossil fuels from 2016–2020.

Oil Change International, Rainforest Action Network, BankTrack, Indigenous Environmental Network, Reclaim Finance, and Sierra Club.

March 2021

This report analyzes fossil fuel financing from the world’s 60 largest commercial and investment banks — aggregating their leading roles in lending and underwriting of debt and equity issuances — and reveals that these banks poured a total of USD $3.8 trillion into fossil fuels from 2016–2020. Fossil fuel financing dropped 9% last year, parallel to the global drop in fossil fuel demand and production due to the COVID-19 pandemic. And yet 2020 levels remained higher than in 2016, the year immediately following the adoption of the Paris Agreement. The overall fossil fuel financing trend of the last five years is still heading definitively in the wrong direction, reinforcing the need for banks to establish policies that lock in the fossil fuel financing declines of 2020, lest they snap back to business-as-usual in 2021.

JPMorgan Chase remains the world’s worst banker of fossil fuels over this time period, though its funding did drop significantly last year. Citi follows as the second-worst fossil bank, followed by Wells Fargo, Bank of America, RBC, and MUFG. Barclays is the worst in Europe and Bank of China is the worst in China. This report also tracks funding for 100 top fossil fuel expansion companies and finds JPMorgan Chase, Citi, and Bank of America to be their biggest bankers over the last half decade, all with significant increases in funding last year despite voicing their support for the Paris Agreement.

The report card also assesses bank policy and practice around financing in certain key fossil fuel subsectors, with league tables and policy grades on:

Tar Sands Oil: 2016–2020 financing was dominated by the Canadian banks, led by TD and RBC, as well as JPMorgan Chase. The Line 3 pipeline is an example of how bank financing backs tar sands expansion and Indigenous rights violations.

Arctic Oil and Gas: JPMorgan Chase, ICBC, China Minsheng Bank, and Sberbank are the biggest funders since the Paris Agreement of companies with major operations in the Arctic.

Offshore Oil and Gas: BNP Paribas’s largely unrestricted financing for the supermajors allowed it to emerge as the world’s worst banker of offshore oil and gas over the last five years.

Fracked Oil and Gas: U.S. banks like Wells Fargo and JPMorgan Chase dominate fracking financing, with Barclays, MUFG, and Mizuho as the biggest funders outside of North America.

Liquefied Natural Gas (LNG): The sector’s biggest bankers over the last half decade, Morgan Stanley, Citi, and JPMorgan Chase, don’t have policies restricting financing for LNG.

Coal Mining: Chinese banks Industrial Bank, China Construction Bank, and Bank of China lead financing for coal mining, and lack policies to rein in this financing.

Coal Power: Coal power financing post–Paris Agreement is led by Bank of China, ICBC, and China CITIC Bank.

Despite the significant drop from 2019 to 2020, the overall trend of the last five years is one heading definitively in the wrong direction. We must go forward to a world where even without a pandemic, fossil fuel production declines almost as quickly every year for the next decade as it did in 2020 — but this time in a managed way. This means that banks must establish policies that lock in the fossil fuel financing declines of 2020, lest they snap back to business-as-usual in 2021. To align their policies and practices with a world that limits global warming to 1.5ºC and fully respects human rights, and Indigenous rights in particular, banks must:

Explicitly acknowledge the central role of the fossil fuel industry as the major driver of climate breakdown, as well as the banks’ own role in financing this sector.

Prohibit all financing for all fossil fuel expansion projects and companies expanding fossil fuel extraction and infrastructure (such as plants and pipelines).

Commit to phase out all financing for fossil fuel extraction and infrastructure, on an explicit timeline that is aligned with limiting global warming to 1.5ºC.

Phase out financing for existing projects and companies active in tar sands oil, Arctic oil and gas, offshore oil and gas, fracked oil and gas, liquefied natural gas, coal mining, and coal power, with ending financing for expansion of these subsectors as an urgent first step.

Fully respect all human rights, particularly the rights of Indigenous peoples, including their rights to their water and lands and the right to free, prior, and informed consent, as articulated in the UN Declaration on the Rights of Indigenous Peoples, and prohibit all financing for projects and companies that abuse human rights, including Indigenous rights.