U.S. Oil and Gas Companies Set to Make Tens of Billions More from Wartime Oil Prices in 2022

With oil prices rising to near-record levels due to Russia’s ongoing war in Ukraine, companies producing oil and gas in the United States are in line to make tens of billions in additional profits. Under conservative estimates, we find the U.S. upstream oil and gas industry will collect a windfall of $37 to $126 billion in 2022 alone.

Published by Oil Change International, Global Witness, and Greenpeace USA.

March 2022

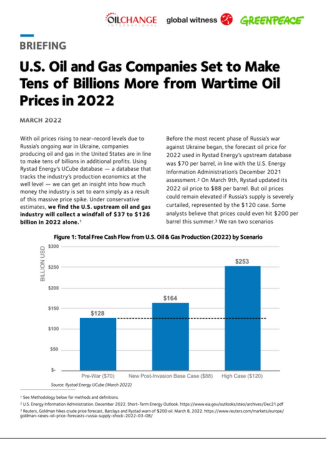

With oil prices rising to near-record levels due to Russia’s ongoing war in Ukraine, companies producing oil and gas in the United States are in line to make tens of billions in additional profits. Using Rystad Energy’s UCube database — a database that tracks the industry’s production economics at the well level — we can get an insight into how much money the industry is set to earn simply as a result of this massive price spike. Under conservative estimates, we find the U.S. upstream oil and gas industry will collect a windfall of $37 to $126 billion in 2022 alone.

Before the most recent phase of Russia’s war against Ukraine began, the forecast oil price for 2022 used in Rystad Energy’s upstream database was $70 per barrel, in line with the U.S. Energy Information Administration’s December 2021 assessment. We find that the U.S. upstream industry is in line to earn an additional $37 billion if the current base case ($88) holds. If prices spike this summer and the 2022 average is closer to $120, earnings could soar by $126 billion compared to the pre-war case.

We also looked at the top ten earners by projected 2022 free cash flow from U.S. oil and gas production. ConocoPhillips, Chevron, and Occidental lead the pack with the potential to earn an additional $6.5 billion to $7.5 billion each if prices average $120. Together the top ten could earn additional profits just shy of $50 billion.

If Congress had taken decisive action on climate change at any time in the last three decades the U.S. economy would be more insulated against oil shocks, and would be enjoying the benefits of a renewable-powered economy that is healthier, more affordable, and more just. The answer to high gasoline prices is not to triple-down on a failed system.