“The internal combustion engine will be long decimated by 2040”

Despite all the predictions about the coming renewable and electic vehicle (EV) revolution, Big Oil is still betting on being able to make oil drilling more efficient to compete with renewables, rather than switching to producing clean energy instead.

Despite all the predictions about the coming renewable and electic vehicle (EV) revolution, Big Oil is still betting on being able to make oil drilling more efficient to compete with renewables, rather than switching to producing clean energy instead.

Essentially, it is still betting on black, when all the predictions are on green.

The Financial Times reports this morning that in a desperate attempt to streamline efficiency, the oil giant BP is betting on “big data” and “artificial intelligence” to improve its performance in drilling for oil and gas.

It is not the only one: “All large oil and gas companies are investing in digital technology as part of wider efforts to increase efficiency at a time of weak crude prices and rising competition from low-cost US shale resources and fast-growing renewable energy,” notes the Financial Times.

In part in its bid to compete with renewables, last month BP invested $20m in a Californian start-up called Beyond Limits, which BP is hoping will allow it to improve its success in future wells. “We see a symbiotic relationship between machines and humans where artificial intelligence optimises the choices for people to make,” Ahmed Hashmi, head of technology for BP’s exploration and production business.

You don’t need to have artificial intelligence to know that the intelligent choice for Big Oil would be to stop risking billions in stranded assets and invest in renewables: In part to prepare for the coming electric vehicle revolution, which will mean the demand for oil and gas will plummet.

The latest warning to Big Oil’s future was released last Friday by Bloomberg New Energy Finance (BNEF). As Bloomberg reported:” Growing popularity of EVs increases the risk that oil demand will stagnate in the decades ahead, raising questions about the more than $700 billion a year that’s flowing into fossil-fuel industries.”

The group predicts EVs to reduce oil demand by 8 million barrels by 2040, more than the combined output of Iraq and Iran.

In a note to clients, Colin McKerracher, head of advanced-transport analysis at BNEF, outlined how: “The number of EVs on the road will have major implications for automakers, oil companies, electric utilities and others.”

Reflecting how fast EV’s are changing predictions, BNEF now expects electric cars to outsell gasoline and diesel models by 2040, by when it predicts there will be 530 million plug-in cars on the road, a third of the global total.

Nearly every day new optimistic forecasts are released about EVs.

For example, last week, the Dutch bank ING outlined how it now believes that all new cars sold in Europe will be electric within two decades. The bank predicts that EVs will “become the rational choice for motorists in Europe” between now and 2024.

The shift has already started with Volvo recently saying it would only launch EV or hybrid models by 2019.

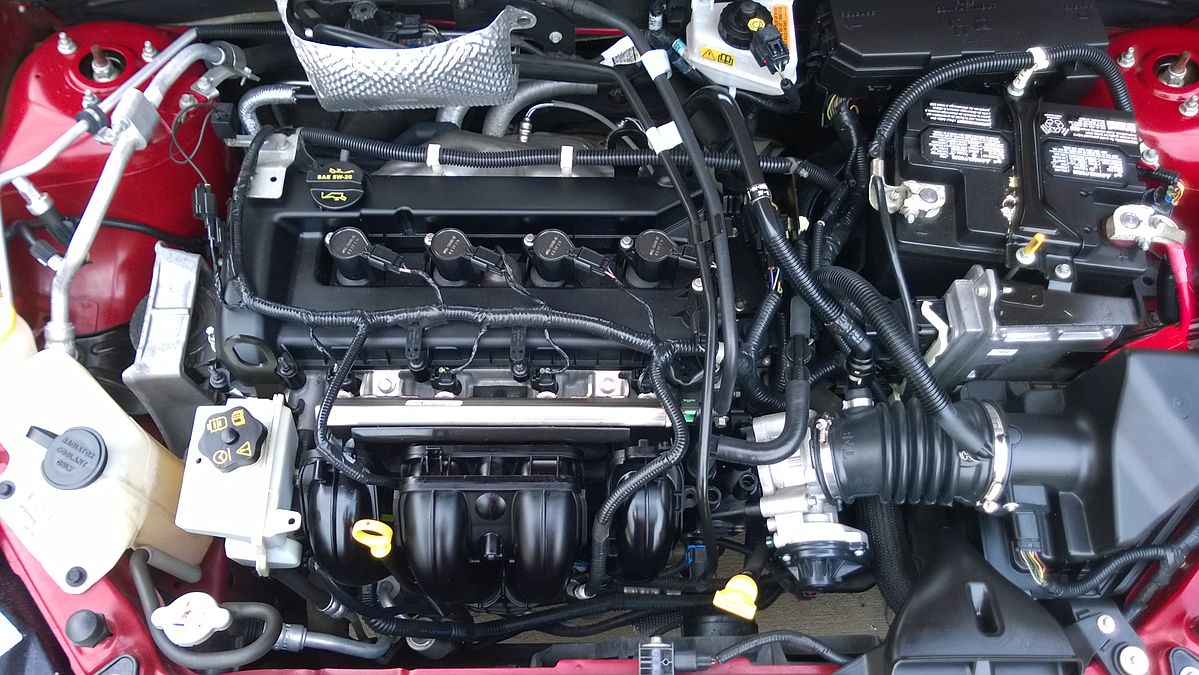

Tony Seba, an economist at Stanford University in the US who has published research on EVs, argues that “the internal combustion engine car industry will have been long decimated by 2040.”

Although the fossil fuel industry is finally sitting up and crunching the EV numbers too, with OPEC, Exxon, BP and Statoil all increasing their projections for EV uptake, they still all belligerently believe that EV’s will not hurt demand for oil.

You don’t need artificial intelligence to know they are so wrong.