From Supermajors to Superminors: the fall of Big Oil

Shell is in trouble. BP is in trouble. So too is Exxon.

Read the latest insights and analysis from the experts at Oil Change International.

Shell is in trouble. BP is in trouble. So too is Exxon.

You cannot underestimate that seismic shift going on as investors, often drunk on big oil profits, now just face uncertainty and loss. The oceans are awash with bobbing tankers full of oil, with no market to sell them. The industry is paralysed by the pandemic.

There is no doubt we are at a historical moment with the industry in deep structural and financial trouble and where a post-COVID-19 recovery could see a radical shift away from oil and into a just transition into renewables. But will that happen?

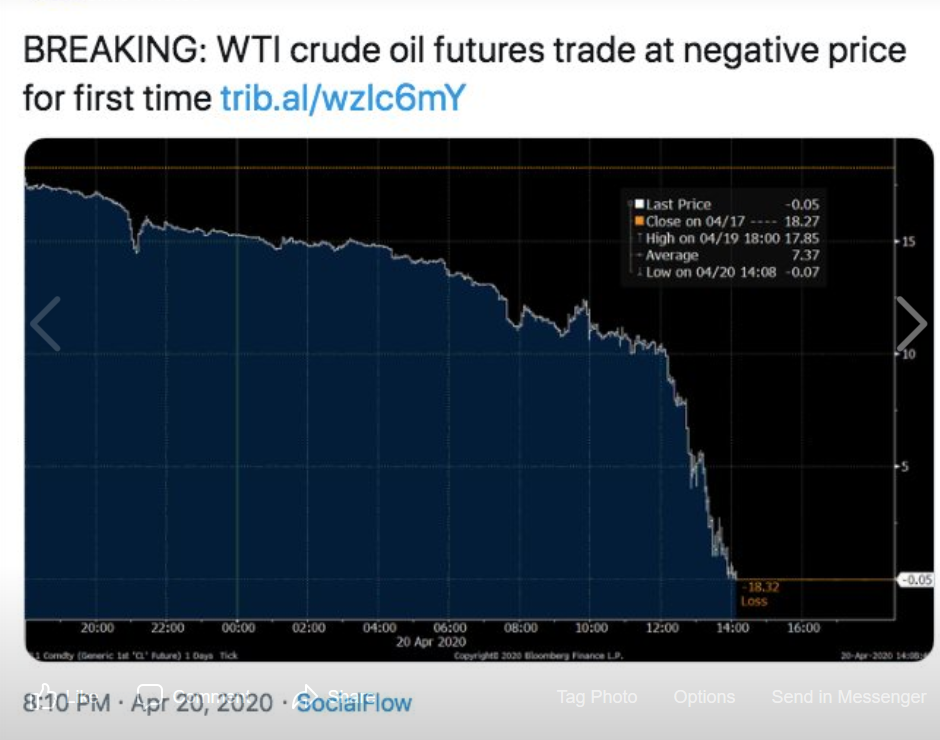

This week the seemingly impossible happened: U.S. oil futures prices went negative for the first time in history. What happens next is up to us.

Later today, U.S. President Donald Trump is set to meet with at least seven senior oil executives in person at the White House to discuss the historic plunge in the oil price.

Warren Mabee, the director of the Institute for Energy and Environmental Policy at Queen’s University, said he "wouldn’t be surprised if Canadian crude prices briefly go negative - a scenario where producers are paying people to take away product.”

The unthinkable could soon be thinkable.

What America needs is a comprehensive vision for energy security, one that goes beyond fossil fuel independence. This plan should entail sustained investment in alternative fuel sources and technologies… If the United States really wants to be energy independent, it must look toward preparing for a post-oil future.”

The disconnect between the need for action to reduce carbon emissions and the fossil fuel fantasy-land that Trump lives in, has never been greater.

According to a new analysis the US now holds more oil reserves than Saudi Arabia and Russia, the first time this has happened. The crux though will be whether the US shale industry can access the finance to carry on exploiting shale. And that remains to be seen.