Top 20 Investor in Exxon Disinvests from Company over Climate Change Stance

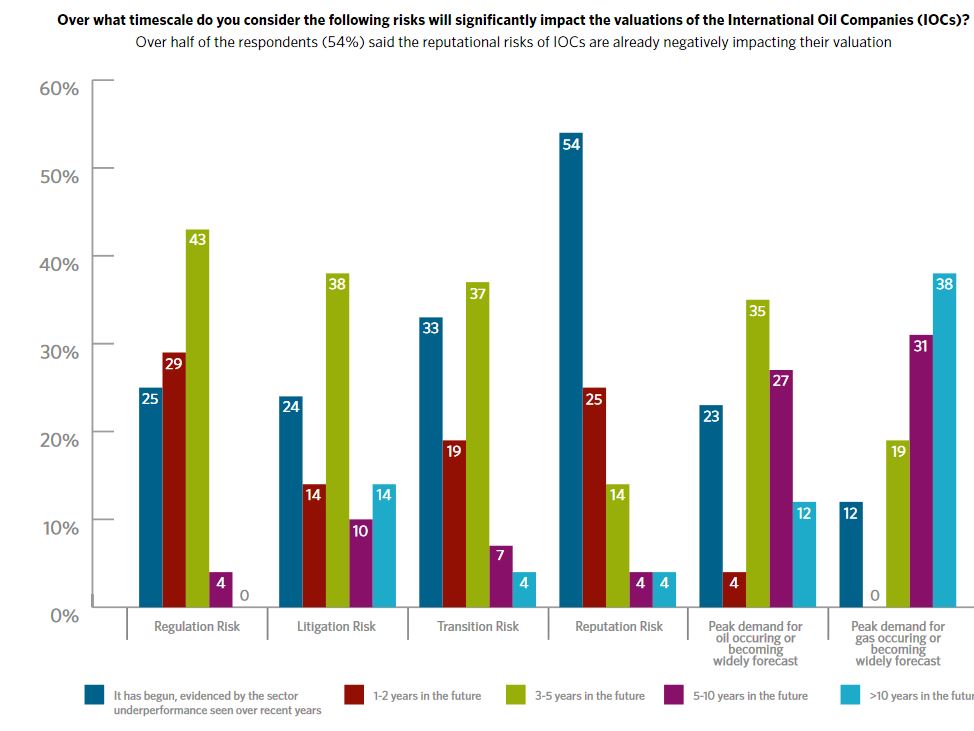

One of Britain’s biggest fund managers has started selling shares in Exxon Mobil, "saying America’s largest oil company isn’t doing enough to address climate change.”

Read the latest insights and analysis from the experts at Oil Change International.

One of Britain’s biggest fund managers has started selling shares in Exxon Mobil, "saying America’s largest oil company isn’t doing enough to address climate change.”

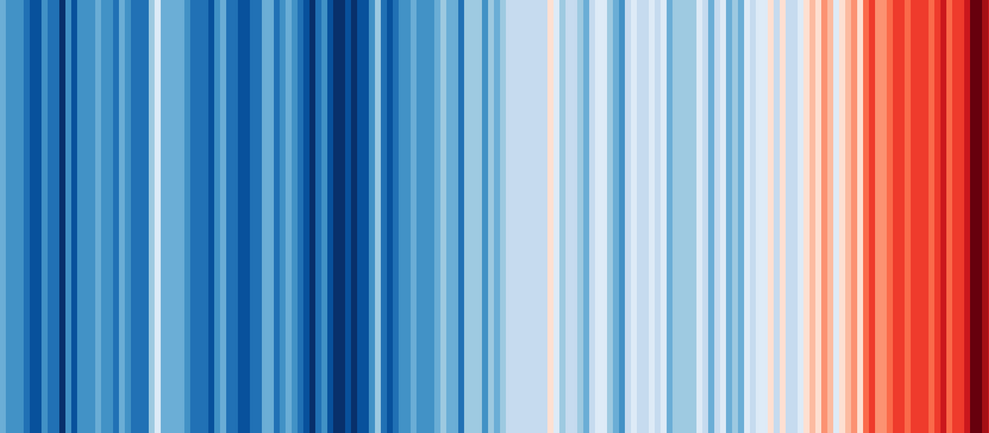

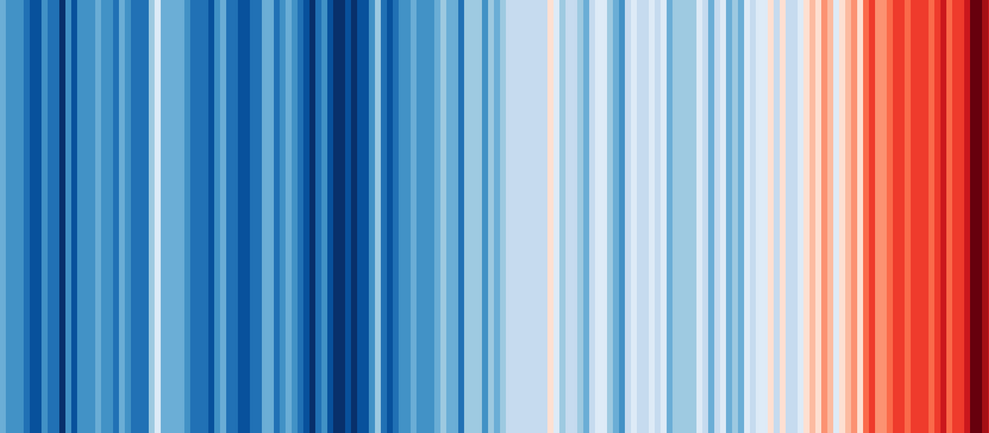

The beginning of the end of the age of oil moved a step closer today

The prospects for the shale industry are looking increasingly bleak this year as it haemorrhages investor cash, continues to experience widespread community resistance, especially in Europe, and fails to find adequate gas reserves.

Last month, Oil Change International and Desmogblog reported on the formation of a new organization, The Institute for Pension Fund Integrity (IPFI), which had published its first “white paper” on “getting politics out of pensions.”

"The fund management sector recognises the imminent risks posed to fossil fuel investments from climate change and the transition toward a zero-carbon economy”

Last week a newly formed organization, The Institute for Pension Fund Integrity (IPFI), published its first “white paper” on the topical issue of “getting politics out of pensions”.

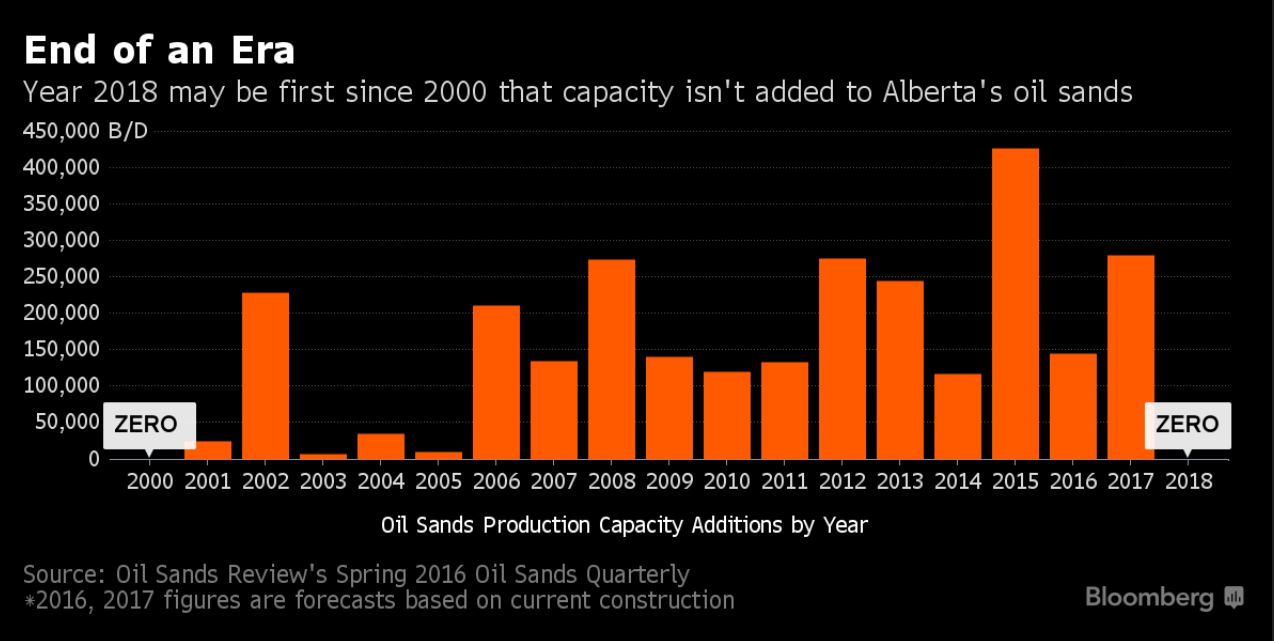

Although Canada’s controversial tar sands industry celebrated a small increase in production last year, this year’s forecast is looking gloomy, as investors continue to take flight over the climate risks and the relatively low oil price means that other oil patches look more profitable.

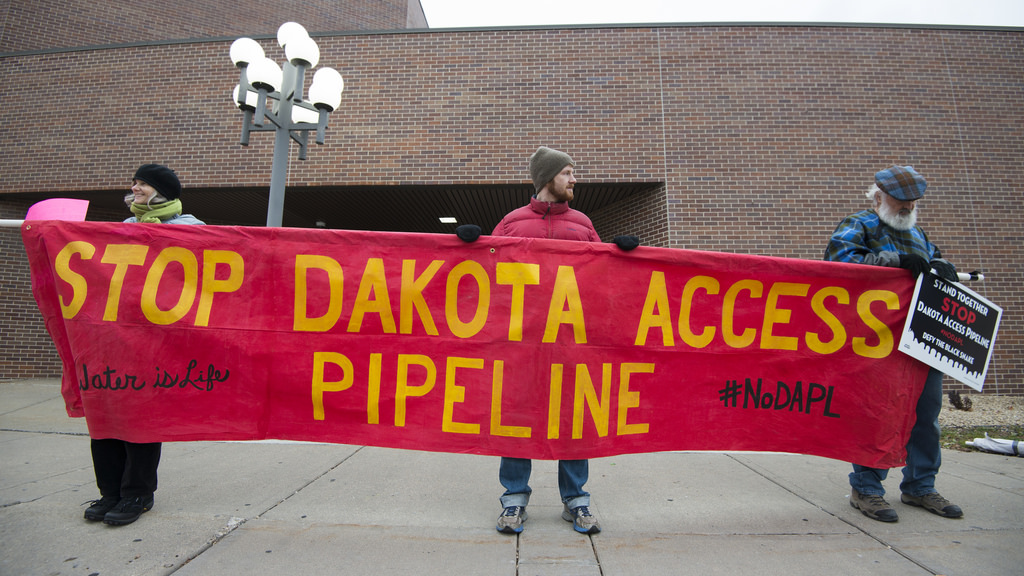

The Mayor of New York, Bill de Blasio, has confirmed that he is “very interested” is using the city’s pension funds to put pressure on the banks that are helping to fund the highly controversial Dakota Access pipeline.

As the fossil fuel disinvestment movement gathers a pace, the loses of US oil companies have reached record levels.

If you had Googled “fossil fuels” and “stranded assets” a few years ago, you would have probably got no hits. But how times change.