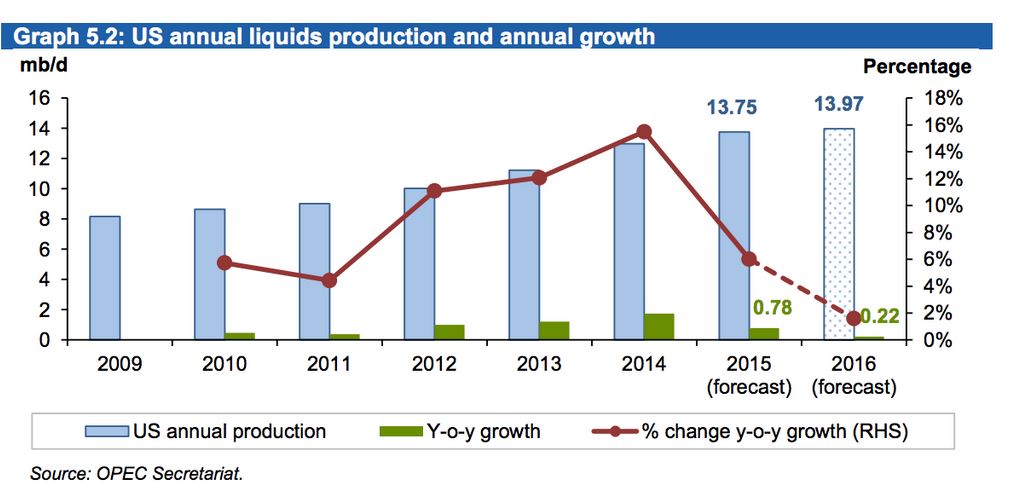

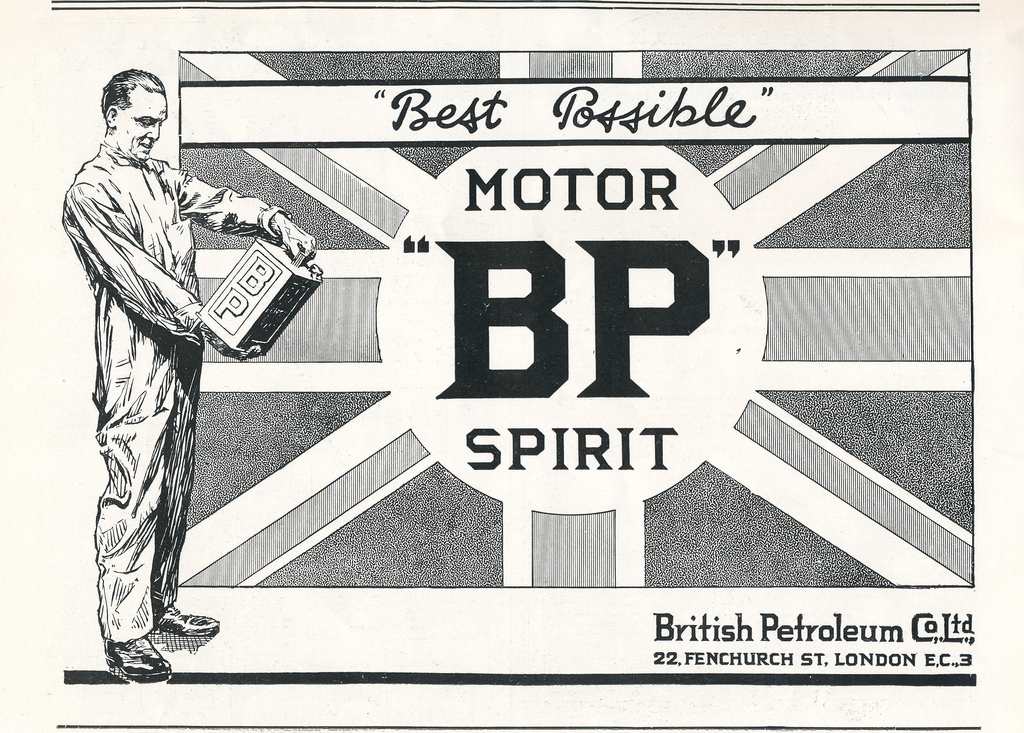

OPEC: “All eyes are on how quickly US production falls”

The oil cartel, OPEC, has confirmed what has been obvious to many for months: US shale production is in deep, deep trouble as the fracking boom bursts in the face of low oil prices.

Read the latest insights and analysis from the experts at Oil Change International.

The oil cartel, OPEC, has confirmed what has been obvious to many for months: US shale production is in deep, deep trouble as the fracking boom bursts in the face of low oil prices.

Those in the oil industry hoping for a reprieve from the volatility of the oil price had their hopes dashed yesterday as the price of oil dropped to its lowest level in four months.

The front pages of many of this morning’s newspapers reflect the ground-breaking pledge by the Group of Seven industrial powers, known as the G7, to decarbonise the global economy by the end of the century.

There has been increasing speculation over the last twenty-four hours that the oil price might start to rally upwards.

As so often in the past, where the tobacco industry leads, the oil industry follows.

How BP's Outlook for Energy looks to the past not the future

Earlier this month, BP’s beleaguered Chief Executive Bob Dudley warned that the falling oil price had created a “raging gale” for the oil industry which could last for years.

One of the great debates about fracking is whether it heralds a great new chapter in the age of oil or whether it is a small blip in the dying days of the fossil fuel era.