Frozen Future: Shell’s Ongoing Gamble in the US Arctic

Frozen Future' warns investors of the risks to shareholder value from Royal Dutch Shell’s Alaskan Arctic drilling program.

Oil Change International publishes upwards of 20 reports and briefings every year focused on supporting the movement for a just phase-out of fossil fuels.

Frozen Future' warns investors of the risks to shareholder value from Royal Dutch Shell’s Alaskan Arctic drilling program.

In 2009, President Obama made a commitment to reduce U.S. greenhouse gases by 17 percent by 2020. The Obama administration put this forward as the U.S. share of a global effort to limit climate change to no more than two degrees Celsius – the target scientists tell us may be safe. Achieving this target, which has been unanimously agreed on a global level, is central to the success of President Obama’s Climate Action Plan, announced in June of last year.

Refineries that may be supplied by Keystone XL continue to increase exports. Gulf Coast refined product exports have grown 172% since 2008.

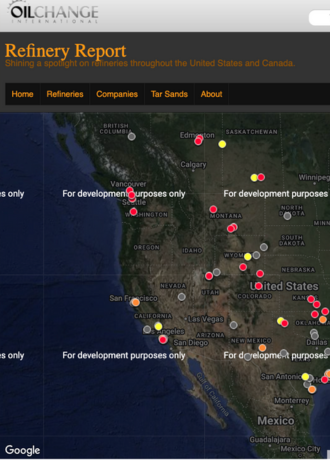

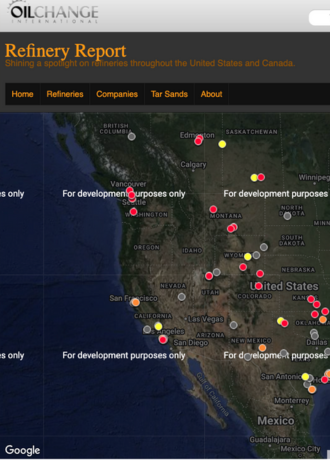

Oil Change International has launched a new online tool today that tracks the flow of Canadian tar sands crude oil to North America’s refineries.

The Refinery Report project will develop and publish data on North America’s refineries, beginning with the amount of crude oil refined from the world’s dirtiest and most destructive source of oil: the Canadian tar sands.

But as shown in a briefing released by Oil Change International today, while Annex 2 (developed) countries continue to debate how to honor their commitment to provide $100 billion each year by 2020 to help developing countries reduce emissions and adapt to climate impacts, these same countries are providing five times more public support for fossil fuel production and consumption than they have so far pledged in climate finance. These fossil fuel subsidies are driving the global growth in greenhouse gas emissions and therefore directly undermining investments to reduce climate impacts.

Our latest report released today exposes U.S. oil producers that want to export crude oil despite the fact that they still only produce barely more than 50% of U.S. oil demand. 40 years on from the Arab oil embargo and America’s oil producers have only one thing on their minds; profits.

The World Bank Group (WBG) increased financing for both fossil fuels and large hydropower significantly this past year, while financing for clean energy dropped. Overall, only 8 percent of the Bank’s energy financing last year was aimed specifically at the poor.

The World Bank’s infrastructure program in Indonesia stipulates policies and government subsidies that promote the accelerated development of over 16 GW of coal power projects in the country ahead of developing feasible renewable alternatives.

The Obama administration’s decision on the proposed Keystone XL tar sands pipeline is a choice about our climate future. Tar sands are one of the most carbon polluting sources of oil on the planet, and limiting tar sands expansion is critical to fighting dangerous levels of climate change. Climate scientists, energy experts, and even Wall Street and industry analysts agree that the oil industry’s plans to expand tar sands development are not possible without this pipeline.