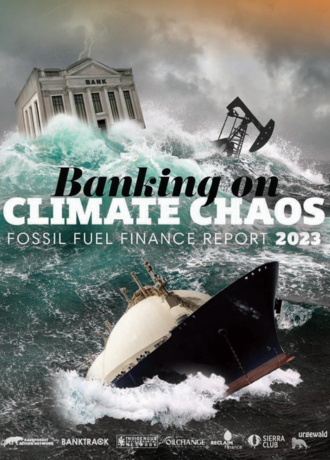

Banking on Climate Chaos 2023: Fossil Fuel Finance Report

This report, Banking on Climate Chaos 2023, analyzes fossil fuel financing and policies from the world’s 60 largest commercial and investment banks. We reveal that fossil fuel financing from the world’s 60 largest banks has reached nearly USD $5.5 trillion in the seven years since the adoption of the Paris Agreement, with $673 billion in 2022 alone.