Refinery Report: New online tool tracks tar sands flows through North America

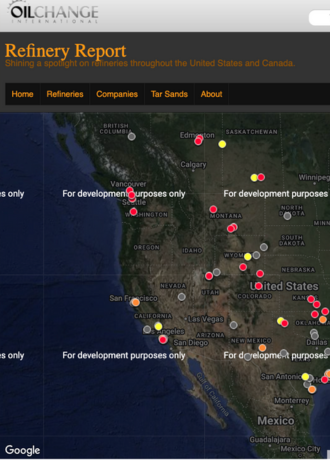

Oil Change International has launched a new online tool today that tracks the flow of Canadian tar sands crude oil to North America’s refineries.

Oil Change International has launched a new online tool today that tracks the flow of Canadian tar sands crude oil to North America’s refineries.

Oil Change International has launched a new online tool today that tracks the flow of Canadian tar sands crude oil to North America’s refineries.

www.refineryreport.org enables users to discover how much tar sands crude is being processed at U.S. refineries and which Canadian refineries are regularly refining this dirty source of crude.

The data for U.S. refineries covers years 2010-2012 and a full analysis, summarized below, gives details of which refining companies process the most tar sands feedstock, as well as a regional breakdown of tar sands flows. These estimates were made by cross referencing multiple data sources and we believe them to be the best publicly available estimates of tar sands refining at American refineries.

Analysis – Download Full Analysis (PDF)

The amount of tar sands crude refined in the U.S. grew by over 40 percent between 2010 and 2012, from 1.15 million barrels per day (bpd) in 2010 to 1.65 million bpd in 2012. The number of U.S. refineries processing tar sands increased from 57 to 66.

The Flint Hills refinery in Pine Bend, Minnesota, refines more tar sands crude than any other refinery in the United States, over 200,000 bpd. Tar sands crude made up 77 percent of the refinery’s feedstock in 2012. Flint Hills Resources is a subsidiary of Koch Industries, which is privately owned by billionaire right wing activists Charles and David Koch. The much smaller (10,000 bpd) Calumet refinery in Great Falls, Montana is the only U.S. refinery to rely on tar sands crude for 100% of its feedstock.

The top ten tar sands refining companies processed over 75 percent of all the tar sands refined in the U.S. in 2012 (see Table 1).

Table 1: Top 10 Tar Sands U.S. Refining Companies – 2012

Over 70 percent of all tar sands crude refined in the U.S. was processed in the Midwest refining region known as PADD 2 (see Table 2). Over one-third of all the crude refined there was sourced from the tar sands. The Rocky Mountain region (PADD 4) is the next biggest market for tar sands crude, refining over 10 percent of tar sands entering the United States.

Table 2: Regional Breakdown of U.S. Tar Sands Refining

Despite being home to over half of America’s refining capacity, the Gulf Coast region (PADD 3) accounted for less than five percent of tar sands crude refined in the U.S. in 2012. Tar sands crude supplied one percent of the region’s refinery feedstock during the year.

With a large number of refineries already equipped to refine heavy tar sands crude, the Gulf Coast region is the number one target for expanding the market for tar sands crude. The expansion of the Seaway Pipeline, which runs from the Cushing, Oklahoma pipeline hub to the Texas Gulf Coast, and the completion of the Keystone Gulf Coast pipeline, which follows a similar route, will increase the flow of tar sands crude reaching the region beginning in early 2014. However, without the Keystone XL pipeline linking Alberta to Cushing, the amount of tar sands crude reaching Cushing will be limited. It remains to be seen to what extent rail or other pipeline expansions may bridge this gap.

So far, the East and West Coast regions (PADDs 1 and 5 respectively) have seen relatively little tar sands crude refining. Five of the East Coast’s eight refineries received small amounts of tar sands crude in 2012. The region accounted for just over one percent of total tar sands crude refined in the U.S. in 2012, with around three percent of all oil refined on the East Coast derived from tar sands.

Tar sands crude has had similarly limited reach on the West Coast, where just over three percent of total crude refined in the region in 2012 came from the tar sands. The West Coast refined slightly over 5 percent of all tar sands crude imported into the U.S. in 2012. Most tar sands crude entering the West Coast region goes to refineries in northern Washington State. Only two refineries in California currently regularly process significant quantities of tar sands crude. But some California refineries are looking into accessing more tar sands crude via rail.

Canadian Refineries

It is much more difficult to gauge the quantity of tar sands crude flowing into Canadian refineries. Unlike the U.S. Energy Information Administration (EIA), Canada’s National Energy Board (NEB) does not track these flows. However, we have determined which Canadian refineries use tar sands crude by searching company information and industry news sources that discuss these refineries.

Nine of Canada’s 16 refineries regularly refine tar sands crude. They are concentrated in Alberta, where tar sands crude is produced, but also in Sarnia, Ontario. Small quantities of tar sands crude are refined in Vancouver and some in Saskatchewan. Refineries in eastern Canada currently have little access to tar sands crude but this could change with reversal of Enbridge’s Line 9 pipeline. The Suncor refinery in Montreal has announced plans to refine tar sands if that pipeline project goes through. The Irving refinery in St. John, New Brunswick announced plans to build a 40,000 b/d terminal for unloading tar sands crude from rail cars. This could be operational in 2014.

Visit RefineryReport Download full analysis of tar sands refining