Past Last Call: G20 public finance institutions are still bankrolling fossil fuels

Our new report “Past Last Call: G20 public finance institutions are still bankrolling fossil fuels” looks at G20 country and MDB public finance for fossil fuels from 2018-2020 for the first time and finds they are still backing at least USD 63 billion per year in oil, gas, and coal projects.

Published by Oil Change International & Friends of the Earth U.S.

October 2021

Our new report “Past Last Call: G20 public finance institutions are still bankrolling fossil fuels” looks at G20 country and MDB public finance for fossil fuels from 2018-2020 for the first time and finds they are still backing at least USD 63 billion per year in oil, gas, and coal projects. This was 2.5 times greater than their $26 billion a year in support for renewable energy in the same period.

Using data from Oil Change International’s Shift the Subsidies database, the report analyzes finance provided by the export credit agencies (ECAs) and development finance institutions (DFIs), as well as the major multilateral development banks (MDBs) that G20 countries control.

Endorsed by 350.org, Above Ground, Asian Peoples’ Movement on Debt and Development (APMDD), Big Shift Global, Both ENDS, CEE Bankwatch, Center for Biological Diversity, Environmental Defence Canada, Friends of the Earth Europe, Friends of the Earth Japan, Fundación Ambiente y Recursos Naturales (FARN), International Institute for Sustainable Development (IISD), Iniciativa Climática de México, Japan Center for a Sustainable Environment and Society (JACSES), Jubilee Australia, Just Finance, Justiça Ambiental/Friends of the Earth Mozambique, Kiko Network, Les Amis de la Terre, Market Forces, Rainforest Action Network, Re:Common, Recourse.org, Réseau Action Climat France, Solutions for Our Climate, Urgewald, and Vedvarende Energi.

SUMMARY

In 2018-2020 G20 countries and the multilateral development banks (MDBs) they govern provided at least USD 63 billion per year in international public finance for oil, gas, and coal projects. This fossil fuel finance was 2.5 times more than their support for renewable energy, which averaged less than $26 billion per year.

This continued support for fossil fuels from trade and development finance institutions counters G20 countries’ commitments under the Paris Agreement to align financial flows with a safe climate future as well as their 2009 commitment to phase out fossil fuel subsidies. It also undermines the effectiveness of climate finance, which is still not delivered at either the scale promised ($100 billion per year from 2020) or needed. Public finance has an outsized impact on global energy systems, providing below-market rates and decreasing financial risks that make projects much more likely to go forward — something that is increasingly influential as the industry faces unprecedented global headwinds. Recognizing this impact, most G20 countries have ended support for coal or will by the end of 2021. Some momentum is now building to end public finance for oil and gas as well, with the UK and European Investment Bank (EIB) passing policies that limit almost all of this remaining fossil fuel finance. COP26 is an important opportunity for other countries around the world to join them.

Using Oil Change International’s Shift the Subsidies database, this briefing builds on past reports Talk is Cheap and Still Digging, which covered 2012-2018 to publish new international public finance data for 2019 and 2020. It looks at the energy project finance of G20 export credit agencies (ECAs), development finance institutions (DFIs), and multilateral development banks (MDBs). Due to gaps in reporting and increased flows to financial intermediaries that are more difficult to track, it is important to note these figures are underestimated. Our analysis shows that:

International public finance for fossil fuels remains large. The 2018-2020 average of $63 billion per year has dropped from the 2012 to 2017 averages of $91 billion per year, but as Figure ES-1 shows, finance levels remain volatile. In the absence of policies to end fossil fuel finance, this drop in 2018-2020 is not guaranteed to be permanent and is far from the complete and immediate end to public support for oil, gas, and coal that is urgently needed. Gaps in transparency and the increase of financial intermediation mean it is also uncertain a decrease has occurred.

51% of international public finance for fossil fuels flowed to gas projects. This $32 billion a year is more than any other energy type received from 2018-2020, and greater than all renewable energy finance combined. In comparison, coal received $8 billion a year and the aggregated “oil and gas” category $23 billion.

International public finance for renewable energy has largely stagnated since 2014. Support for renewable energy has fluctuated between $20 billion and $27 billion per year since 2014 instead of growing exponentially as is needed to support a globally just energy transition.

ECAs were the worst public finance actors, providing 11 times as much support for fossil fuels than clean energy with $40 billion per year for fossils and just $3.5 billion for clean energy.

DFIs and MDBs continue to finance fossil fuels despite their mandates for sustainable development: DFIs financed $16 billion in fossil fuels a year 2018-2020, twice as much as their support for renewable energy. MDBs financed $6.4 billion a year in fossil fuels, just under half of their support for renewable energy.

Annual G20 and MDB public finance for fossil fuels, clean energy, and other energy, 2012-2020, in USD Billions

Source: Oil Change International Shift the Subsidies Database.

At the country level, we find that:

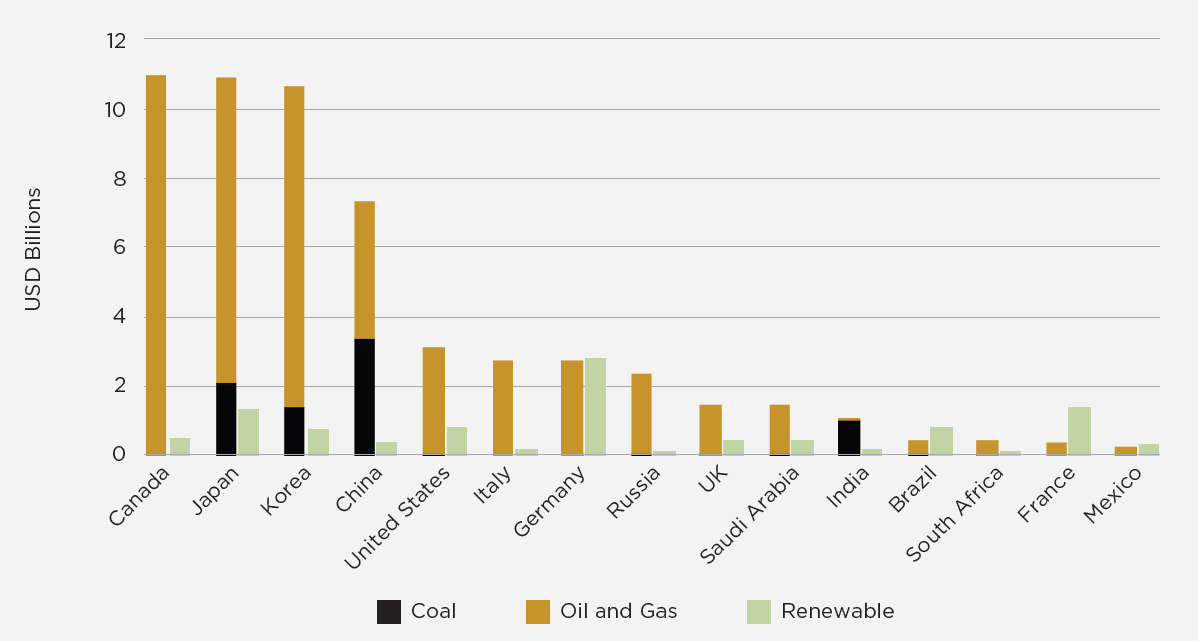

Canada, Japan, Korea, and China again provided the most public finance for fossil fuels between 2018 and 2020 at $11.0 billion, $10.9 billion, $10.6 billion, and $7.3 billion a year respectively, together accounting for 46% of the MDB and G20 fossil fuel finance in our dataset.

Germany, France, and Japan provided the most public finance for renewable energy, at $2.8 billion, $1.4 billion, and $1.3 billion respectively. These levels are still many times lower than needed to meet climate targets.

Most fossil fuel finance flowed to wealthier countries, countering industry claims that this money supports energy access or development. Of the top 20 recipients of public finance for fossil fuels, only one was low-income by the World Bank classification (Mozambique), six were lower-middle income, and the remainder were upper or middle income.

Renewable energy finance was also overwhelmingly concentrated in wealthy countries. For renewable energy, there were no low-income countries in the top 20 and just three lower-middle income countries.

Top 15 G20 countries for international public finance for fossil fuels compared to renewable energy, annual average 2018-2020, USD billions

Source: Oil Change International Shift the Subsidies Database.

We also map government and institution-level restrictions for finance for fossil fuels and find:

Following widespread commitments to end public finance for coal, a small but growing group of ‘first movers’ is now phasing out public finance for oil and gas. The UK, European Investment Bank (EIB), and Sweden have passed policies restricting almost all oil and gas finance, and the US has signaled its intention to follow suit. Ten other G20 governments or institutions have added partial restrictions on oil and gas finance. The UK and the EIB are expected to lead a wider joint statement committing to end public finance for all fossil fuels with new signatories at COP26.

As part of their fair share to limit warming to 1.5°C and ensure a liveable future, G20 governments and the MDBs they control must:

Implement whole-of-government policies (or whole-of-institution policies in the case of MDBs) to immediately end new public direct and indirect finance for oil, gas, and coal projects.

Engage in targeted diplomacy to end public finance for fossil fuels internationally.

Provide their fair share of debt cancellation and climate finance to countries in the Global South. This will allow for the rapid scale up of renewable energy, energy efficiency, just transition planning, energy access, and other climate solutions in line with an equitable pathway to 1.5°C. To avoid deepening inequalities, these projects must be implemented with strong human rights due diligence and have planning that is inclusive of and takes leadership from local governments, workers, communities, CSOs, and trade unions.

Ensure transparent and timely reporting on all energy finance.