Top 20 Investor in Exxon Disinvests from Company over Climate Change Stance

One of Britain’s biggest fund managers has started selling shares in Exxon Mobil, “saying America’s largest oil company isn’t doing enough to address climate change.”

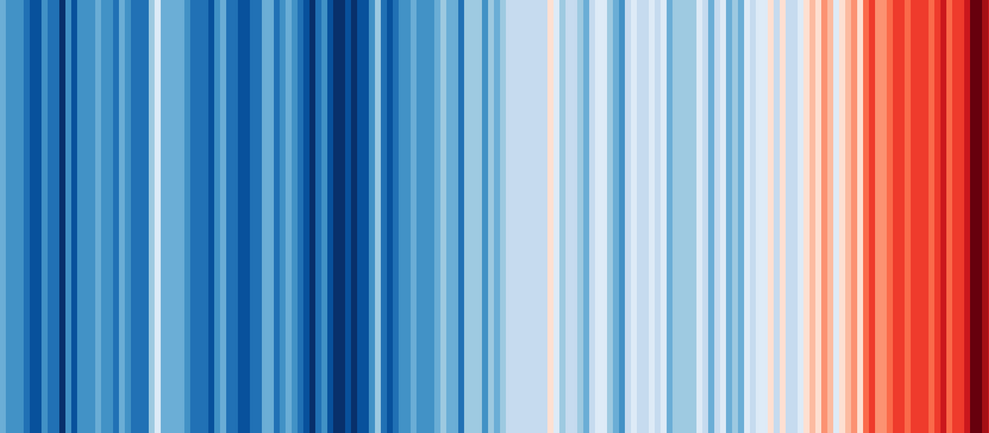

C: showyourstripes.info/

The image is striking. These “warming stripe” graphics are visual representations of the change in temperature as measured in each country over the past 100+ years.

Each stripe represents the temperature in that country averaged over a year.

For most countries, the stripes start in the year 1901 and finish in 2018. For virtually every country or region, the stripes turn from mainly blue to mainly red in more recent years, illustrating the rise in average temperatures in that country.

So who is responsible making blue go red? We know that just 100 companies are responsible for some seventy percent of carbon emissions since 1988.

Two years ago the Carbon Majors Report highlighted how the “highest emitting companies since 1988 that are investor-owned include: ExxonMobil, Shell, BP, Chevron, Peabody, Total, and BHP Billiton.”

By the late eighties, Exxon knew the dangers of climate change, but instead of acting to combat climate change, it is now well documented that Exxon funded a systematic, well financed climate denial campaign. What the company knew and what it hid from investors has become what is known as the #Exxonknew scandal, which has now reached the courts.

But increasingly those investors are losing faith in Exxon, too.

Earlier this month, the company voted down various shareholder resolutions trying to force action on climate change. The company’s senior hierarchy had had to walk past a banner reading: “Climate Crisis: Exxon Knew, make them pay.”

Writing about the event, Kathy Mulvey from the Union of Concerned Scientists, noted that “ExxonMobil’s leadership has shown before that it lives in its own virtual reality [regarding climate change]—and that’s why investors are losing confidence” in the company’s senior management.

And now it seems some investors have had enough. According to Bloomberg, one of Britain’s biggest fund managers has started selling shares in ExxonMobil, “saying America’s largest oil company isn’t doing enough to address climate change.”

The fund, Legal & General Investment Management, oversees in excess of $1 trillion and is one of Exxon’s top 20 shareholders. It confirmed to Bloomberg that “some of its funds have already divested from the company” and it was asking its clients if it can withdraw more money.”

Meryam Omi, head of sustainability at Legal & General Investment Management told Bloomberg that divestment was the way to “hold Exxon accountable for something that’s really material for their future.”

The news comes as Greenpeace has launched an online “People’s Climate Injunction” against the fossil fuel companies too. Exxon’s problem is that its climate denial campaign and stance is now costing it serious money and ruining its reputation. And the campaign to hold it to account for its climate crimes will only intensify.

Greenpeace tweeted:

Fossil fuel companies, you’ve done your best to wreck our planet. You knowingly misled us for decades about the dangers of #ClimateChange, and now we’re serving you with a People’s Climate Injunction. No more fossil fuels.

RT to add your name pic.twitter.com/E12Wl021z0

— Greenpeace International (@Greenpeace) June 20, 2019