Trump’s reckless grab for power, riches, and oil in Venezuela

A Venezuelan oil industry controlled by Trump and his cronies won’t benefit ordinary Venezuelans or Americans. Instead, it will enrich oil company executives and elites while destabilizing the country and worsening the climate crisis.

Who stands to profit, and who stands to pay?

“Ten years from now, twenty years from now, you will see; oil will bring us ruin. Oil is the Devil’s excrement” – Juan Pablo Pérez Alfonso, former Venezuelan Minister of Mines & Hydrocarbons and co-founder of OPEC, 1975

President Trump’s attack on Venezuela and abduction of President Maduro last weekend have been widely condemned as an illegal act of war and a shocking abuse of power. They are a power grab designed to rewrite the new world order in a Trumpian fashion. The President has even coined the phrase “Donroe Doctrine,” based on the historic Monroe Doctrine, which laid foundational claims for the U.S. over the whole Western Hemisphere. This is fossil-fueled imperialism, plain and simple.

The Trump administration’s actions in Venezuela are a clear warning shot across the bows of other Latin American countries that have historically challenged U.S. power in the region, like Cuba. Some media commentators also believe the military action is designed to undermine China, which currently receives eighty percent of Venezuelan crude. But Trump’s attacks could also embolden Chinese and Russian aggression against other nation-states, further destabilizing the world.

But there is no doubt that oil is a core element of Trump’s plan, with one financier on the creditor committee of Venezuela’s sovereign debt, arguing that Trump’s gamble on Venezuela could “reorder the entire energy configuration of the world.”

But the reorganization of Venezuela’s oil industry faces numerous headwinds, including ongoing instability and the tens or hundreds of billions of dollars required to rebuild the country’s decrepit infrastructure. Despite share price jumps in the wake of Maduro’s capture, real profits for Big Oil could be a long way off.

Even if Trump succeeds in increasing oil production in Venezuela, the oil industry’s business model will ensure that the lion’s share of revenues and profits will never reach the Venezuelan people and could even cost American taxpayers, who may end up subsidizing oil companies’ return to Venezuela. Only foreign companies and members of Venezuela’s already powerful petro-elite are likely to benefit.

The climate will also lose. Even Trump himself has admitted that the country’s carbon-intensive oil, with a high sulphur content, is “the dirtiest, worst oil probably anywhere in the world.” The country is the fifth-largest gas flarer, according to the World Bank.

“If oil production goes up, climate change will get worse sooner, and everybody loses, including the people of Venezuela,” John Sterman, an expert in climate and economics at the Massachusetts Institute of Technology, told the Guardian.

Below, we detail some of the prominent entities that stand to benefit from a takeover of Venezuela’s oil and explain how people in Venezuela and the U.S. will bear the costs.

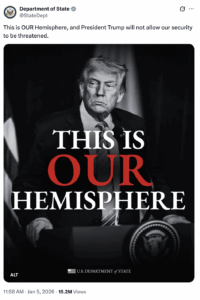

“Our Hemisphere” and “our stolen oil”

The Trump administration’s agenda in Latin America was made clear in the National Security Strategy published in November 2025. “After years of neglect, the United States will reassert and enforce the Monroe Doctrine to restore American preeminence in the Western Hemisphere.”

For Venezuela and others, this doctrine had already been in play for months with attacks on alleged drug boats and a massive military build-up in the region. For Trump, control over the resources in the U.S.’s sphere of influence is a key part of the “Donroe Doctrine,” particularly energy resources.

Trump has clearly and publicly positioned oil as a major part of the Venezuela strategy, with all his usual flair for misinformation, exaggeration, and brash bravado. “We’re going to have our very large United States oil companies—the biggest anywhere in the world—go in, spend billions of dollars, fix the badly broken infrastructure—the oil infrastructure—and start making money for the country,” he boasted after Maduro’s capture.

Trump claims that Venezuela illegally “took all of our oil not that long ago. And we want it back. ” Trump is presumably referring here to the renegotiation of oil assets instigated by President Hugo Chávez in 2007.

What actually happened was not unusual. Oil-producing countries have often sought to renegotiate terms with international oil companies to get a better deal. Chávez proposed that the national oil company Petróleos de Venezuela (PdVSA) should control a majority share in all operations in the country. Chevron renegotiated and stayed, and is now the only remaining U.S. company operating in Venezuela. Others, such as ConocoPhillips and Exxon, left and sought compensation through a World Bank arbitration panel that awarded them billions. Not all of that money has been paid back yet. European companies such as ENI (Italy) and Repsol (Spain) also stayed.

Speaking on Fox and Friends, Trump said, “We’re going to be very strongly involved” in Venezuela’s oil industry, adding, “We have the greatest oil companies in the world, the biggest, the greatest, and we’re going to be very much involved in it.”

Who stands to win?

If Trump’s ambitions are successful, which is a big if, American oil companies could clearly profit handsomely from renewed access to Venezuela’s oil riches. The potential winners come in three categories.

- Oil producers and service companies extracting Venezuelan oil

- Refineries on the U.S. Gulf Coast configured to refine heavy oil

- Private equity, hedge funds, and other investors

“The greatest oil companies in the world”

The only U.S. oil company still in Venezuela, Chevron’s history in the country goes back over a century. Gulf Oil, which Chevron acquired in 1984, opened its first office there in 1923. It left in the 1970s in the first wave of nationalization, but returned in 1996 to enter the joint venture it still operates today with PdVSA. Due to this long history and ongoing presence in the country, Chevron is widely seen as uniquely well-positioned to reap the benefits of lifted sanctions and any enduring political stability.

Exxon and ConocoPhillips left in 2007 and won billions in compensation that has yet to be fully paid. At least one expert analysis has questioned the legitimacy of these awards, concluding ExxonMobil and ConocoPhillips used the arbitration process to, in effect, “re-draft” contract terms and capture windfalls they were never guaranteed. Trump has misleadingly labelled what happened to these companies as theft in an attempt to portray his power grab as an act of justice, or at least retribution. According to the New York Times, ConocoPhillips was negotiating an oil trading deal with Maduro as recently as last year. While neither company has made any official statement since Maduro’s capture, both are likely to explore how they can get the compensation they have sought for the past 19 years, and possibly more.

As reported by Drilled, ExxonMobil and Chevron also stand to benefit from U.S. coercion over Venezuela in another way – to the extent it helps secure their investments and growing production in neighboring Guyana. Maduro’s government had been escalating a border dispute involving Guyana’s oil-producing region, which is critical to Exxon’s global expansion plans.

Some of Trump’s major fossil fuel donors are also looking to get in on the action, despite having no history in Venezuela. Harold Hamm, the influential fracking billionaire and close advisor to Trump, told the Financial Times that his company, Continental Resources, would “definitely” consider investing in Venezuela with “improved regulatory and governmental stability.” While these oil producers are the obvious candidates for gaining access to Venezuela’s oil riches should they open up, there are plenty of others likely jockeying for an opportunity. European companies ENI and Repsol have also maintained operations in the country and are likely to be eyeing opportunities to expand.

Oil Service Companies

Oil production companies like Exxon and Chevron often contract with oil service companies to handle the day-to-day operations of their extraction projects. These oil service companies could benefit from lucrative service contracts.

On Monday, the stock of Halliburton jumped nearly 10 per cent, with other oilfield-services stocks such as SLB and Baker Hughes also rising. Halliburton, a Houston company with long associations with former Vice-President Cheney, and the debacle of the Iraq war, filed what has been labeled an “unusual lawsuit” seeking $200 million in compensation from Venezuela just weeks before Maduro’s capture. The suit claims that Halliburton’s departure from Venezuela, resulting from U.S. sanctions, was Venezuela’s responsibility. According to The Lever, Halliburton stands to benefit if a U.S.-friendly government willing to settle claims were installed in Venezuela.

U.S. Gulf Coast Refiners

Refineries on the Gulf Coast could see benefits from Trump’s aggression in Venezuela sooner than oil producers. Many Gulf Coast refineries are configured to refine exactly the kind of heavy, high-sulfur oil that dominates Venezuela’s oil production. At their peak in 1997, they processed around 1.4 million barrels per day (bpd) according to Reuters. In 2025, with total Venezuelan output at around 1.1 million bpd, roughly two-thirds of which is heavy, Gulf Coast refineries received only about 140,000 bpd. Much of the rest went to China.

If Trump’s actions lead to Venezuela’s oil being rerouted to the Gulf Coast, the increase in heavy oil supply lowers the price for refiners there. Currently, heavy oil supply to Gulf Coast refiners is dominated by Canadian oil delivered by pipeline. Imports from Mexico and Venezuela have declined due to depletion in Mexico and sanctions on Venezuela. With new flows from Venezuela, the Gulf Coast market will be well-supplied, lowering prices. We’re already beginning to see this happen. Following Trump’s announcement on Tuesday evening that Venezuela has agreed to send 30-50 million barrels of oil to the U.S., Bloomberg reported that Canadian heavy crude prices on the Gulf Coast “collapsed” on Wednesday.

As one analyst effused on a popular stock trading news website, “If you own Valero, Phillips 66, or Marathon Petroleum, you just won the lottery.”

Private Equity and Other Investors

Anyone who holds shares in the companies discussed above saw a bump in share price immediately after Maduro’s capture. If the country opens up to U.S. investment and increases oil production, these gains could be larger and more enduring. But what about the other big players? The private equity investors, hedge fund managers, and other superrich elites who may, or may not, have the inside scoop on what’s really going on and how a quick profit can be made?

One hedge fund that has garnered a lot of attention in the past few days is Elliott Investment Management, founded by Paul Singer, a billionaire Trump donor. Elliott’s $6 billion bid to acquire Citgo, a U.S. refining operation that was considered a “crown jewel” of Venezuela’s oil assets, was approved by a federal judge just last November. The sale still requires regulatory approval, which the Financial Times believes is now more likely following Maduro’s removal. Citgo operates three refineries in the U.S., two on the Gulf Coast, that are configured to refine Venezuela’s heavy oil.

According to the Wall Street Journal, “Elliott appears poised to reap the rewards of owning Venezuela’s most valuable foreign oil asset. The regime change could lead to an increase in Venezuelan oil production, which would likely provide cheap feedstock to Citgo’s Gulf Coast refineries and increase the company’s value.”

Figure 1: Oil Company Share Increases on January 5 and Contributions to Trump/GOP Campaigns and Inaugural Committee

| COMPANY | SHARE PRICE INCREASE ON MONDAY, JANUARY 5 | TOP CONTRIBUTIONS TO THE TRUMP CAMPAIGN, REPUBLICAN CANDIDATES AND PACS IN 2024 | CONTRIBUTIONS TO THE TRUMP INAUGURATION COMMITTEE |

| Chevron | 5.1% increase | $9.4 million | $2 million |

| Halliburton | 7.9% increase | $290,000 | |

| ExxonMobil | 2.2% increase | $1 million | $1 million |

| ConocoPhillips | 2.6% increase | $5.7 million | $1 million |

Notes: Other oilfield-services and refiner stocks such as SLB, Baker Hughes, and Valero also rose on Monday, January 5. Contributions are sourced from Open Secrets. We include all contributions linked to the companies (including affiliated PACs and individuals) to the Trump campaign, Republican candidates and party, and aligned PACs. Contribution figures are rounded to two significant digits.

Who loses and how

The raid on Venezuela reportedly killed at least 75 people, 32 of them Cuban. The Trump administration’s actions in Venezuela, from the arbitrary killings of people on alleged drug boats to the seizure of oil tankers and the incursion into Caracas, make clear that there is no longer even a pretense that international laws and norms apply to those who consider themselves superpowers. We are all losers in this new world disorder.

It is important to recognize that the U.S. is already the world’s largest oil and gas producer and historical climate polluter. U.S.-backed investment to increase Venezuela’s oil production over the next couple of decades will also add fuel to the ongoing climate crisis. The majority of Venezuela’s oil reserves are heavy oil, which is especially damaging to our climate. Even if it weren’t, existing fossil fuel production is enough to push the world far past 1.5 degrees of warming, exposing more communities to climate disasters.

Communities on the frontlines of health impacts from this production would also lose: The U.S. refineries built to process Venezuela’s heavy oil are largely located in the U.S. Gulf Coast, where Black, Latino, Indigenous, and low-income communities are already exposed to devastating levels of fossil fuel pollution.

Oil companies are so far cautious about restarting production in Venezuela due to ongoing political instability and the massive amounts of capital required. Energy analysts at Rystad Energy estimate that it would take around $53 billion in investment over the next 15 years just to maintain Venezuela’s current level of crude oil production at 1.1 million bpd. Raising output back to Venezuela’s former heyday levels of 3 million bpd would require at least $183 billion over the next two decades. These would be high-risk investments in a world where oil demand is still on track to peak in the next five years, with Trump’s policies so far unable to single-handedly derail a global energy transition gaining pace.

Should they go ahead, however, the risks will likely be shunted onto the public. The Venezuelan people will likely see few benefits, and the U.S. taxpayer will likely bear huge costs. Here’s how.

Rystad suggests that international companies would supply a portion of the capital needed to restore Venezuela’s oil industry, but that a significant portion would come from PdVSA. This implies that PdVSA would have to reinvest much of its oil sales revenue to support this effort, rather than on much-needed social services or the development of the rest of Venezuela’s ailing economy. On top of this, international creditors are likely to line up to seek repayment on Venezuela’s massive, onerous debts, of which a significant portion is linked to PdVSA, repeating a cycle of injustice seen across the Global South, where many governments are trapped spending more on debt servicing than on health or education.

It could be decades before PdVSA receives meaningful revenues from a revitalized oil industry because of the structure of profit-sharing agreements typically demanded by international oil companies, especially when investing in countries where they’ve been burned before. These agreements typically entitle the company to the majority of oil revenues during the period of “capital repayment,” while the host country receives only a minority. The kind of capital and time horizons indicated by Rystad suggest there could be a period of more than two decades from when investment begins to when Venezuela would start receiving the majority of its revenues from new oil production.

The Trump administration could attempt to sweeten the deal for U.S. oil companies that are cautious about investing in Venezuela by offering subsidies, i.e., taxpayer dollars.

A former Trump administration official already suggested that U.S. vehicles for subsidizing its corporations’ operations abroad, such as the Export-Import Bank and the International Development Finance Corporation, could be required to do so. That would be on top of the nearly $35 billion the federal government already spends each year to subsidize the fossil fuel industry.

While millions go without health care and struggle to get ahead in an increasingly polarized economy, Trump’s action threatens to funnel even more wealth toward billionaires and oil industry stockholders on the backs of working people in the U.S. On top of a worsening climate crisis, this administration refuses to even acknowledge exists, and increasing global instability and conflict that is harming people all over the world, Trump’s actions threaten us all. As we are seeing in real time, however, those harmed first and worst by these intersecting crises are the Global South countries, too long treated as resource colonies for Western powers.

A Venezuelan oil industry controlled by Trump and his cronies won’t benefit ordinary Venezuelans or Americans. Instead, it will enrich oil company executives and elites while destabilizing the country and worsening the climate crisis.

Trump’s reckless, illegal strikes in Venezuela are another step towards dismantling an international order that was supposed to be based on cooperation and respect for sovereignty, however often it failed in practice. None of us is safe in a world where fossil-fueled imperialism is the norm. To protect our communities from climate disasters and resource wars, we need to reject extractive energy models and build democratic systems that prioritize community health and safety.