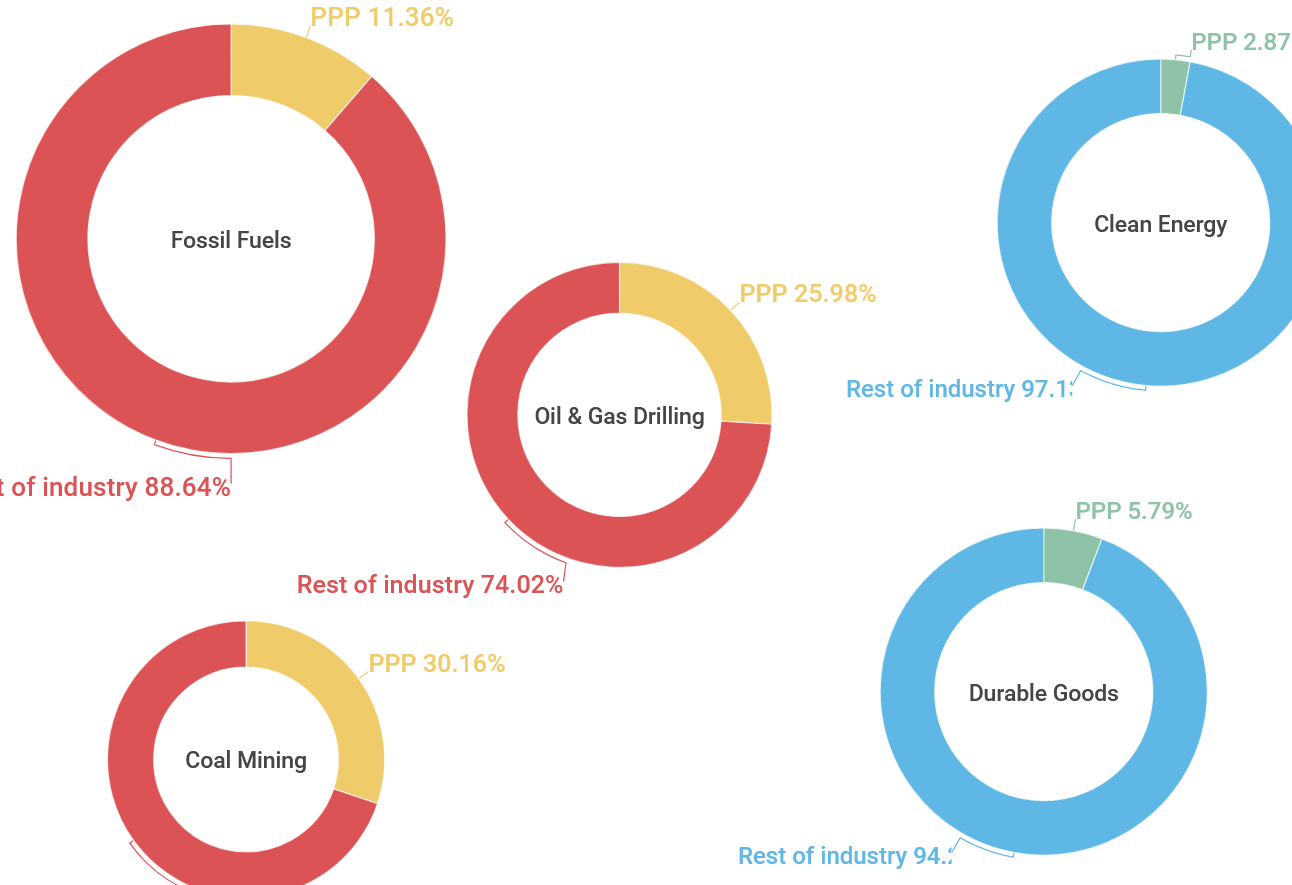

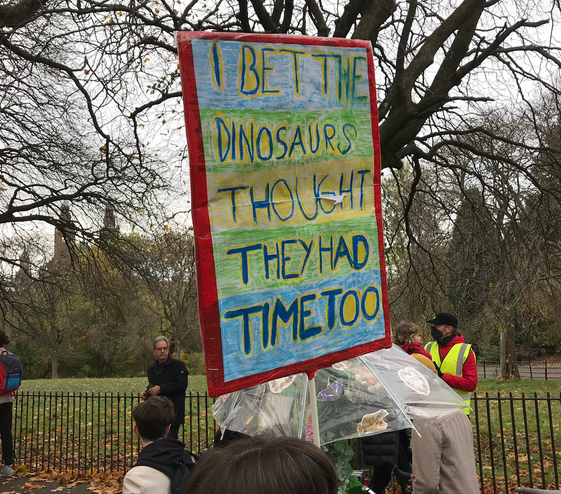

Half of world’s fossil fuel assets could become stranded by mid 2030s

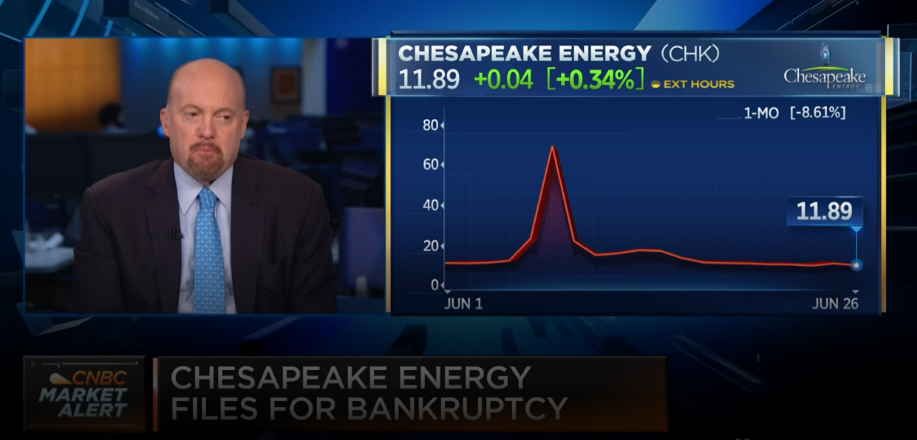

Scientists are warning that “large quantities of fossil fuel reserves and resources are likely to become ‘unburnable’ or stranded if countries around the world implement climate policies effectively". And up to half the world's fossil fuel assets could be stranded by the mid 2030s