Shale Oil Jobs “Vastly Exaggerated”

The headline in yesterday’s Financial Times said it all “Surge in shale oil output fuels US jobs bonanza”.

The headline in yesterday’s Financial Times said it all “Surge in shale oil output fuels US jobs bonanza”.

According to the FT: “The boom in shale oil and gas production has created one bright spot in the otherwise grim US labour market.”

“The rate of job growth is noteworthy,” Brian Davidson, an economist with the US Bureau of Labor Statistics, told the paper.

Lets move on a few hours, because it looks like this so-called bonanza could be more smoke and mirrors from the industry. The NGO Food and Water Watch released a report entitled, “Exposing the Oil and Gas Industry’s False Jobs Promise for Shale Gas Development: How Methodological Flaws Grossly Exaggerate Jobs Projections”.

Food and Water pointed out that the American Petroleum Institute and major oil and gas corporations are spending millions to convince Americans that with unrestricted access to natural resources, they can lift us from our economic slump in part by fracking our nation’s shale gas reserves.

But its new report, unsurprisingly, finds that the industry is exaggerating the capacity of shale gas development to generate jobs, in one case exaggerating projected job creation by a whopping 900 per cent.

“The oil and gas industry has tried to stand on three legs, claiming that shale gas is good for the environment, good for American energy security and good for the economy. The first two legs have already been kicked out, and our new analysis kicks out the third,” said Food & Water Watch Executive Director Wenonah Hauter. “They have no legs left to stand on.”

The report argues that In contrast to industry supported claims, an analysis of actual data shows little evidence of large scale job gains.

The report reveals that opening up five counties in the southern tier of New York to shale gas development can be expected to generate a net gain in employment of only about 2 jobs per well. This is in huge contrast to the 125 jobs per well that other studies have found.

So where is the money from fracking going to?

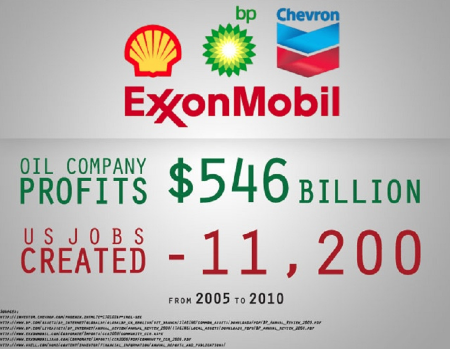

In 2010, ExxonMobil, Chevron, BP, Shell and ConocoPhillips, all involved in shale gas development, paid their executives a total of nearly $220 million and recorded $73 billion in profits. However, that same year the Big 5 oil companies reduced their global workforce by a combined 4,400 employees. So in some regions the industry is doing more firing than hiring.

“While President Obama’s recent move to delay his decision on the Keystone XL Pipeline is a sign that his administration is attuned to public concern about the negative effects of tar sands, we hope he will not replace it with shale gas development,” added Hauter. “The oil and gas industry has exploited our economic woes to promote shale gas, yet actual employment data shows that it is not a cure-all for our nation’s economic challenges”.

So don’t believe the fork-tongue hype from the industry when it comes to jobs.